Well, here we go again. The rigged game of meme-stock trading is back in vogue, evidently. GameStop (NYSE:GME) stock traders deserve the credit or, perhaps, the blame for this. I won’t win any popularity contests for this, but I am bearish on GME stock and expect this mania phase to end badly, just like it did after the 2021 hype cycle (see the chart below).

If anybody cares anymore, GameStop sells physical copies of video games and, to a lesser extent, digital copies of games. Generally speaking, today’s gamers directly download or stream their video games instead of purchasing them through GameStop.

The problem is that financial traders have notoriously short attention spans – but you don’t have to fall into that trap. I sincerely hope that this message reaches you before you commit your hard-earned capital to GameStop stock, only to probably end up regretting it later on.

GameStop: The Unusual Reason for the Rally

As I’ll describe in a few moments, Wall Street’s analysts barely cover GameStop (and the one Wedbush analyst covering GameStop definitely isn’t bullish). That’s because seasoned investors don’t take the company very seriously. However, GameStop stock – I mean the stock, not the company itself – garnered a lot of attention in 2021. Fast-forward to May 13, 2024, and the original meme stock of the 2020s is top-of-mind once again.

As covered by TipRanks contributor Shrilekha Pethe, as well as by Bloomberg and others, GME stock unexpectedly zoomed higher on Monday, even doubling in price at around 10:00 a.m. Eastern time. Thanks to Pethe’s reporting, I quickly learned that there weren’t any company-prompted catalysts on May 13, such as an earnings report or an announcement from GameStop’s CEO, Ryan Cohen.

Instead, the event that got meme-stock traders excited was a posting from “Roaring Kitty,” or @TheRoaringKitty, on social-media platform X. Previously a prolific Reddit user and meme-stock guru, “Roaring Kitty” posted on X on Monday, and this was his first X or Reddit posting since the height of stock-market speculative fervor in 2021.

Judging from his X posting, it looks like “Roaring Kitty” didn’t have much to say, as the post was just an image of a video game player sitting in an upright position in a chair. Is he suggesting that he’s now sitting up and paying attention to something after a lengthy absence?

GameStop: It’s All FOMO and YOLO

For what it’s worth, there’s no denying that “Roaring Kitty” has some clout in the online trading community. Judging by Monday’s stunning surge in GME stock, it’s clear that meme-stock traders haven’t lost their sense of FOMO (fear of missing out) and YOLO (you only live once).

Financial Insyghts President Peter Atwater succinctly summed up the still-considerable influence of “Roaring Kitty” and the implications of Monday’s apparent meme-stock revival.

“That he is able to generate a crowd says that the crowd is back to feeling FOMO and YOLO in an enormous way… When people dive into things that are of pure speculative value, their confidence is extremely high and this is one of the ways that it manifests,” Atwater explained.

The key phrase here is “pure speculative value.” With TipRanks’ tools at my disposal, I can immediately discern that GameStop isn’t on rock-solid ground when it comes to the company’s fundamentals.

The GameStop financials page is particularly useful here. As it turns out, the company has negative free cash flow (FCF) and roughly $600 million in total debt.

Furthermore, on the GameStop earnings page, I discovered that Wall Street’s consensus forecast calls for the company to flip from an adjusted profit in Q4 2023 to an adjusted loss in Q1 2024. Only time will tell whether GameStop actually lost money in the first quarter, since the company is expected to release its earnings report on June 5.

Yet, eager meme-stock traders have already pumped up the GameStop share price prior to the earnings report. Now, GameStop has the unenviable burden of having to justify its sky-high share price – just like in 2021, and that story didn’t end well in 2022, 2023, and early 2024.

To finish this cautionary note, I’ll defer to the wisdom and experience of Giacomo Pierantoni, head of data at Vanda Research. He warned, “These surges in retail activity have served as contrarian signals, prompting institutional investors to quickly short the stock following these rallies driven by retail investors.” So, would you rather be on the side of the retail crowd or the large-scale whales?

Is GameStop Stock a Buy, According to Analysts?

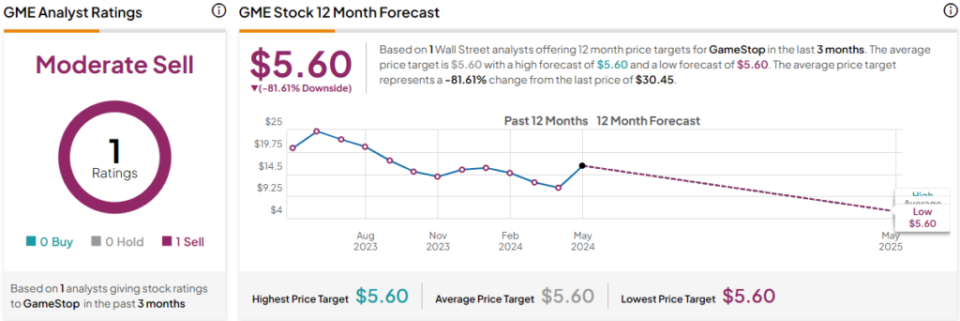

On TipRanks, GME comes in as a Moderate Sell based on one Sell rating assigned in the past three months. GameStop stock’s price target is $5.60, implying 81.6% downside potential.

Conclusion: Should You Consider GameStop Stock?

The strange surge in GameStop stock might be a “contrarian signal,” to borrow a phrase from Pierantoni. However, I don’t recommend trying to fade today’s move and short-sell the stock. That’s just asking for trouble.

On the other hand, serious investors should think long and hard about GameStop’s fundamentals. The company has to deal with weak consumer spending and strong competition. Short-term traders might ignore the red flags, but I believe you shouldn’t. All in all, the game is rigged against investors who chase GME stock in hopes of long-term gains, and I’m definitely not considering buying any shares today.