A Hollywood movie can be two things at the same time. It can be a great piece of art and also a poor business decision. It often takes years to find out if the first designation applies. With the second, people know right away, for the most part.

“Furiosa: A Mad Max Saga” is a commercial bomb. There’s no way around it. The prequel opened to a disappointing $32 million during the long Memorial Day weekend. In its second go-around, it dropped 59%, coming in third place behind Sony Pictures’ animated “The Garfield Movie” and Paramount Pictures’ John Krasinski-directed hybrid “If.”

The George Miller-directed action thriller’s box office tally of $50 million domestic ($114 million worldwide) so far on a $168-million production budget is just plain bad, adding to the summer woes that have the movie exhibition industry in a spiral of existential dread, once again.

The numbers for the theater chains are worrying, overall, with May doing nothing to quell the trepidation that kicked off with the previous month and the sluggishness of “The Fall Guy.”

According to David A. Gross’s FranchiseRe newsletter — a reliable source of level headed box office analysis — May domestic grosses were down 43% from the average of the three years before the COVID-19 pandemic. Ticket sales so far this year have fallen nearly 25% from the same period in 2023.

The reasons for the decline are fairly straightforward. I tend to agree with Gross’ perspective: that for a variety of reasons, including production delays induced by last year’s writers’ and actors’ strikes and a general pullback by cost-conscious studios, there haven’t been enough movies, and the films that have been released aren’t hitting in the way they need to be.

The hollowed out release schedule is doing the expected damage. This past weekend had no new releases in the domestic top five. This week, Sony will try to liven things up with “Bad Boys: Ride or Die.”

“Moviegoing thrives on momentum and rhythm: one strong movie after another bringing fans to the multiplex once or more per month,” Gross wrote. “Right now, the schedule is thin, several big releases fell short, and the original stories are not breaking through (with the exception of ‘If’).”

It’s also clear to me that there are broader structural issues at work. The combination of the pandemic theater closures, the six-month production disruption and the age of post-streaming wars austerity has conspired to constrict the supply of studio films in theaters. But there’s also the increasing consumer mind-share taken up by streaming, video games, social media and cheap, free short-form online content.

Add to that the entertainment giants’ self-sabotaging strategy of shortening the theatrical window in a way that has trained at least some viewers to wait at home for anything other than a “Barbenheimer”-level cultural phenomenon. There’s also the fact that consumer motivations have changed in a fundamental way for a number of people. If seeing a movie in theaters doesn’t have any social media cachet, why bother paying a babysitter?

But these issues don’t explain the failure of “Furiosa,” which was fairly predictable. Prequels are a tough sell for audiences. How many prequels have actually succeeded in recent years? Certainly not “Solo: A Star Wars Story.” Paramount will again test the audience’s appetite later this month with “A Quiet Place: Day One,” an extension of its successful horror franchise.

By the way, maybe let’s stop putting “A So-and-So Story and/or Saga” in movie titles for the time being. That formulation doesn’t appear to be enticing people.

Anyway, “Furiosa’s” struggles have inspired think pieces positing that Hollywood has fallen victim to its own sky-high, irrational box office expectations. My colleague Mary McNamara made such an argument, referring to the current situation as a “box office doom loop.”

My own reaction to the “Furiosa” performance is narrower and more basic. The movie just didn’t work as a commercial product.

As we’ve discussed previously, “Mad Max: Fury Road,” which grossed $380 million globally, wasn’t even that big of a hit in the first place, though its reputation has grown massively since its debut in 2015. So yes, betting on a prequel was a major gamble, banking on the hope that people outside the core demographic of men over age 35 would care. Generally speaking, they didn’t.

A big budget bomb is undoubtedly bad news for Warner Bros. But it says something about the state of the film business that the fate of Warner Bros. Discovery hinges more on whether David Zaslav can hold onto the NBA rights for TNT.

So yes, film fans can be grateful that “Furiosa” exists and disappointed that it flopped. But while the film depicts the aftermath of a terrifying apocalypse, it isn’t, by itself, necessarily a sign of one.

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

Skydance’s David Ellison nearing deal for Paramount after sweetened offer. Both sides are optimistic that they are on the finish line of a agreement. Competing offers have come in for Paramount’s parent company, National Amusements, but controlling shareholder Shari Redstone has long favored Ellison’s proposal.

Los Angeles loses ground to rivals in film and TV employment but remains the biggest player. L.A. is still the film and TV industry leader despite production levels rising in rival markets, according to a new Otis College report.

What’s going on with loan-out corporations? Hollywood workers seek answers. Hollywood labor unions are “closely” monitoring a move by the California Employment Development Department to crack down on loan-out companies, which are widely used in the entertainment industry.

How Netflix is using ‘Too Hot to Handle’ games to build its reality TV audience. As Netflix continues to invest more in games, it is expanding its titles based on its popular reality shows, including “Too Hot to Handle” and “Selling Sunset.”

Other news:

AMC Theatres CEO says leaks nearly tanked Beyoncé deal

Nelson Peltz cashed out his Disney stake

Spotify raises prices on premium plans

Trump felony conviction coverage boosts ratings

Number of the week

Think Netflix’s film business is all about computer-generated action (“Red Notice”) and would-be Oscar bait (“May December” and “Maestro”)? That idea is belied by the company’s most recent trove of viewership data, which covers the second half of last year.

The charts show that the No. 1 movie on Netflix during the last six months of 2023 was what many might consider a surprising choice: “Leave the World Behind.”

Sam Esmail’s adult-skewing apocalyptic drama, starring Julia Roberts, Ethan Hawke and Mahershala Ali, generated 121 million views globally on the platform. Netflix says the film, based on the Rumaan Alam novel of the same name, is its fifth most-watched movie ever.

Why might that be? Reviews were solid, though not universally positive. The book was well received, but it’s not a massive piece of established intellectual property. What’s clear is that star power matters on streaming, and Roberts is a big enough name to get viewers’ attention when her face shows up on the Netflix carousel.

“Leave the World Behind” was released under the Netflix film regime led by Scott Stuber, who has been replaced by Dan Lin. Netflix’s film strategy might change (perhaps by backing away from auteur-led passion projects and blockbuster-type movies starring the Rock). However, star-driven down-the-middle projects seem to work well for the company.

Another big film title for Netflix was “Leo,” the Adam Sandler talking lizard cartoon, which garnered 96 million views, which, by the way, are calculated by dividing the time spent watching by the movie’s run time.

“Leo” is the most popular Netflix animated film to date, according to the company. Netflix is still benefiting from getting into the Sandler business, an early decision by the company that bolstered its viewership with flicks such as “Murder Mystery” and “Hubie Halloween.” With “Leo,” it seems the relationship is still paying off.

Film shoots

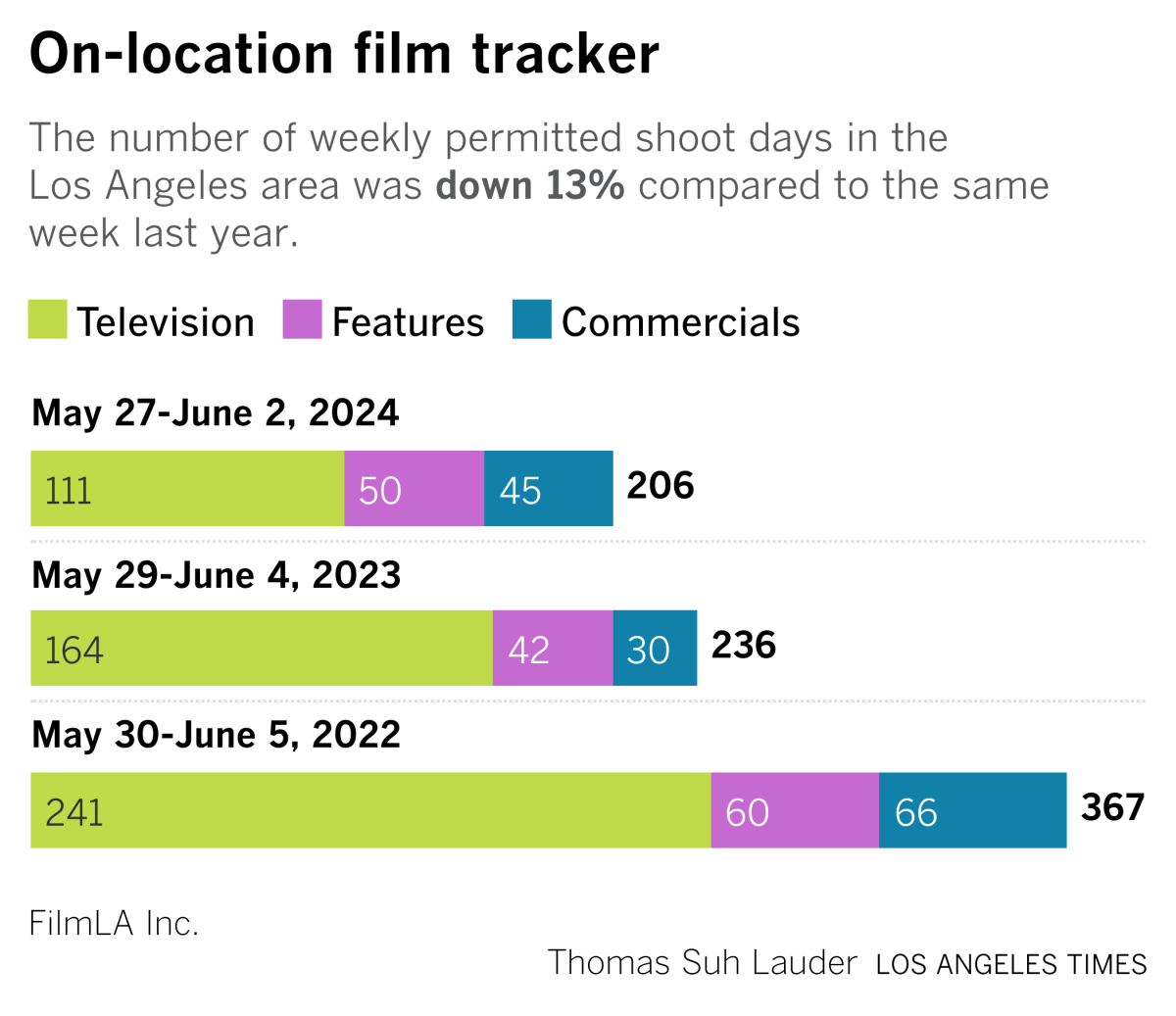

Production in Los Angeles last week was still down 13% from a year ago, according to FilmLA.

Finally …

The Atlantic published what should be required reading for media pros and consumers: a thoughful piece from Jessica Lessin on the risks news organizations are taking by getting cozy with artificial intelligence firms.