Warner Bros. Discovery’s rough ride continued through its most recent quarter, with the company taking a $9-billion write-down to reflect the diminishing value of its struggling television channels.

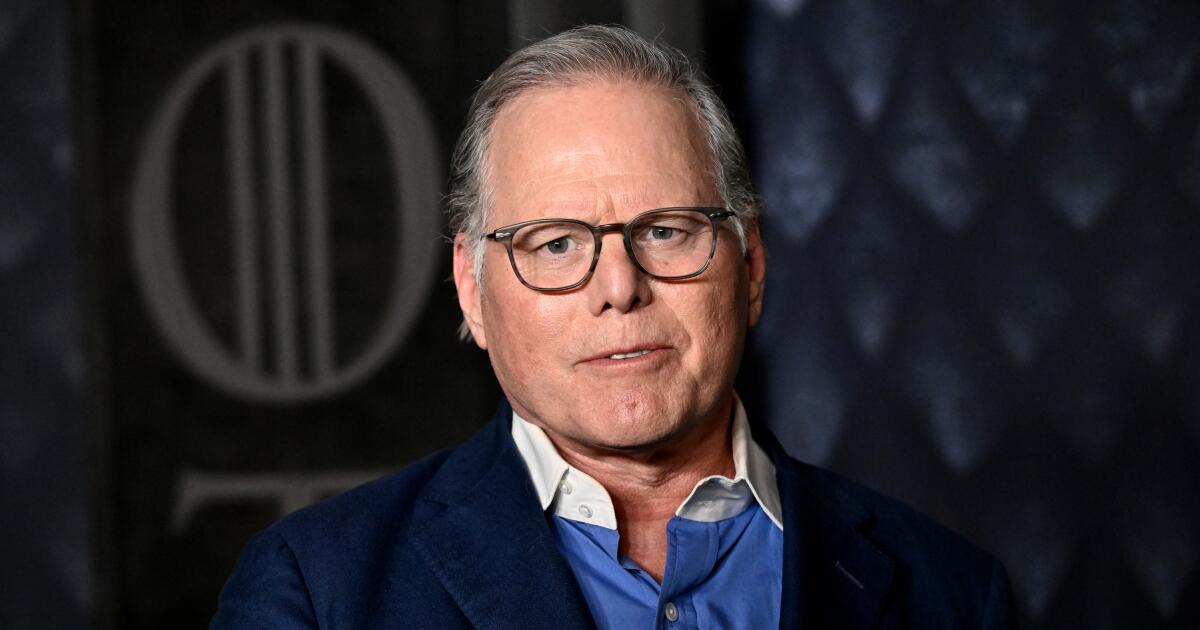

The David Zaslav-led media company posted disappointing second-quarter earnings Wednesday, sending its shares tumbling in after-hours on Wall Street. The company continues to grapple with cost cuts to rein in its $38 billion in debt, a legacy of its 2022 takeover of the larger WarnerMedia from AT&T.

The New York company generated revenue of $9.7 billion, which marked a 6% decline compared with the same quarter a year earlier.

Adjusted earnings before interest, taxes, depreciation and amortization fell 16% to nearly $1.8 billion compared to $2.1 billion in the year-earlier period. Last year, the company spent less on programming due to the Writers Guild of America strike.

But the immediate takeaway was the company’s staggering $10-billion net loss, which it said included the $9.1 billion impairment charge from its TV networks division as well as $2.1 billion in “acquisition-related amortization of intangibles and restructuring expenses.”

The company blamed continued softness in advertising revenue coming to its linear television business, which includes CNN, TBS, HGTV, TLC, Animal Planet and the Food Network. It also noted the “uncertainty related to affiliate and sports rights renewals, including the NBA.”

The earnings come less than two weeks after Warner Bros. Discovery filed a breach of contract lawsuit against the NBA, asking a judge to prohibit the league from awarding a television contract to Amazon Prime Video.

The suit, which was filed July 26 in New York Supreme Court, alleges that the NBA breached Turner Broadcasting’s current deal by allegedly refusing to honor the cable programmer’s rights to match an offer from Amazon for the contract period that begins with the 2025-26 season.

The league bypassed Turner, its broadcast partner since 1989, while striking deals with Walt Disney Co.’s ESPN, NBCUniversal and Amazon. The NBA is expected to respond to Turner’s lawsuit later this month.

The company said it repaid $1.8 billion in debt during the second quarter. It ended the April through June period with $3.6 billion in cash on hand.

Global direct-to-consumer subscribers grew to 103.3 million by the end of the quarter, which was boosted by the second season of HBO’s “House of the Dragon.” The company said its ongoing European rollout of streaming service Max was successful, with the offering now available in 65 countries and territories.