Natural resource depletion happens when resources are consumed faster than they can be replenished. This phenomenon triggers significant environmental and economic consequences, such as soil erosion, shrinking ecosystems, and declining wildlife populations. Economically, dwindling resources drive up prices and stifle growth. Neither sounds like a party I want to attend.

A similar, though less severe, situation seems to be unfolding in the entertainment industry. Just as forests are depleted for raw materials, entertainment budgets have been slashed in recent years. Despite the highest number of writers ever working in Hollywood last year, their earnings fell by $600 million due to strikes. Additionally, the 2024 domestic box office is currently 18% behind last year’s and 32% lower than the pre-pandemic year of 2019. This contraction in the industry mirrors a resource shortage, with streaming services reflecting this shift.

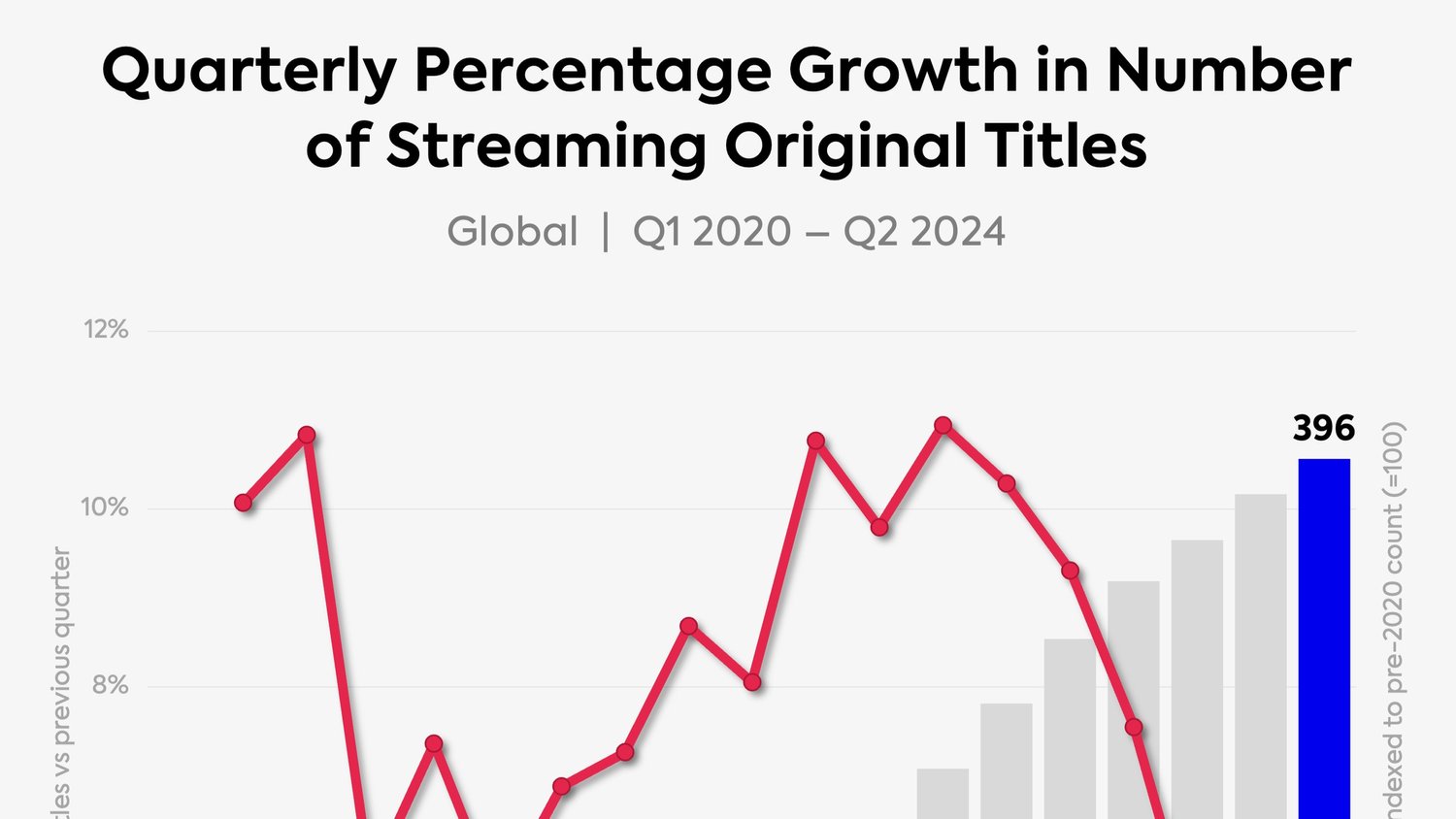

From early 2020 through Q2 2024, there was a notable 296% increase in the global supply of streaming original titles. Major media and tech companies prioritized direct-to-consumer platforms, emulating Netflix’s juicy Wall Street-approved business model. This strategy worked for a time, but by 2022, the market had overcorrected, leading to significant shifts since then.

In 2023, the growth rate of streaming original titles began to slow, with a decrease observed every quarter. Although there was a slight uptick in Q1 2024, the growth rate has declined in five of the last six quarters, according to Parrot Analytics. Specifically, the rate of new quarterly streaming titles fell from 11% pre-pandemic to just 3.9% last quarter.

In other words, while new shows are still being produced — what would 2024 look like without Shogun, Baby Reindeer, and Fallout — the pace has markedly slowed. This deceleration is partly due to major companies reassessing their business models and the impact of Hollywood labor strikes in late 2023. The reduction in volume pressures two crucial aspects of streaming success: hit rate and engagement volume.

Let’s explore both aspects logically.

As the volume of new streaming shows declines, the importance of hit rate — the frequency with which a platform delivers commercially successful shows — increases. While extensive original slates are costly, they offer more opportunities for success. A single major hit, like Bridgerton, can offset numerous failures, such as Cowboy Bebop. The big wins subsidize the losses.

Fewer original series mean fewer opportunities to create a hit. Home runs drive subscription growth, so with reduced chances for success, each new show must be meticulously planned. This includes considerations of concept, casting, creative execution, marketing, and release window/timing. While a smaller library allows for easier quality control — Disney+ and Apple TV+ lead the major streamers in average title demand, while Netflix sits at the bottom, per Parrot — striking a balance between quality and strategic content choices remains challenging. Streaming platforms must optimize every new show to enhance its chances of success.

Additionally, a shrinking volume of new content impacts library size. As Bloomberg recently pointed out, “There is a direct link between how much time people spend watching your service and how likely they are to keep paying.” A diverse portfolio with numerous options is essential for maintaining engagement and minimizing churn. Viewers should seamlessly transition between blockbuster series, feel-good sitcoms, reality TV, sports, and dramas.

For Netflix, this means licensing product from rival companies, which is generally more cost-effective than original development. Shows like Breaking Bad, Friends, The Office, Suits, and Your Honor have proven valuable for Netflix over the years. For other companies with extensive back catalogs, this should theoretically be easier. However, many of these legacy media studios are still losing money on streaming and must license content externally — often to Netflix — to generate necessary revenue. To quote Fat Bastard from Austin Powers, “It’s a vicious cycle.”

So, with less money flowing into the entertainment industry, how can companies maintain a steady stream of breakout originals while building a robust library of exclusive content? Despite their high salaries, I wouldn’t want to be in David Zaslav’s or Bob Iger’s shoes right now.

Navigating these challenges requires more than just strategy; it demands a deep understanding of audience behavior and market trends. To thrive in a period of relative scarcity, companies must aim to outperform competitors with informed, strategic decisions. Achieving this requires essential insights into content and market dynamics.