Microsoft shares rose as much as 5% in extended trading on Thursday after the software maker issued fiscal third-quarter results that outdid Wall Street’s expectations.

Here’s how the company did in comparison with the consensus from LSEG:

- Earnings per share: $2.94 vs. $2.82 expected

- Revenue: $61.86 vs. $60.80 billion expected

Microsoft’s total revenue grew 17% year over year in the quarter, which ended on March 31, according to a statement. Net income, at $21.94 billion, or $2.94 per share, was up from $18.30 billion, or $2.45 per share in the year-ago quarter.

With respect to guidance, Microsoft’s finance chief, Amy Hood, called for $64 billion in revenue for the fiscal fourth quarter, below the $64.5 billion LSEG consensus. Hood’s forecast implies an operating margin of 42.3%, ahead of the StreetAccount consensus of 41.5%.

“Currently, near-term AI demand is a bit higher than our available capacity,” Hood said. Microsoft has been increasing its capital expenditures to secure Nvidia graphics processing units for training and running artificial intelligence models.

During the fiscal third quarter, Microsoft’s Intelligent Cloud segment, including the Azure public cloud, Windows Server, Nuance and GitHub, generated $26.71 billion in revenue. That’s up about 21% and more than the $26.26 billion consensus among analysts surveyed by StreetAccount.

Revenue from Azure and other cloud services grew 31%, compared with 30% in the previous quarter. Analysts polled by CNBC had expected 28.8%, while the StreetAccount consensus was 28.6%.

Inside of the Azure growth, 7 percentage points were related to AI, up from 6 points of impact in the previous quarter. Microsoft provides cloud services for the ChatGPT chatbot from startup OpenAI, and companies have been increasingly adopting Azure AI services to develop their own capabilities for summarizing information and writing documents.

The capacity bottleneck cut into the AI portion of Azure growth, Hood said.

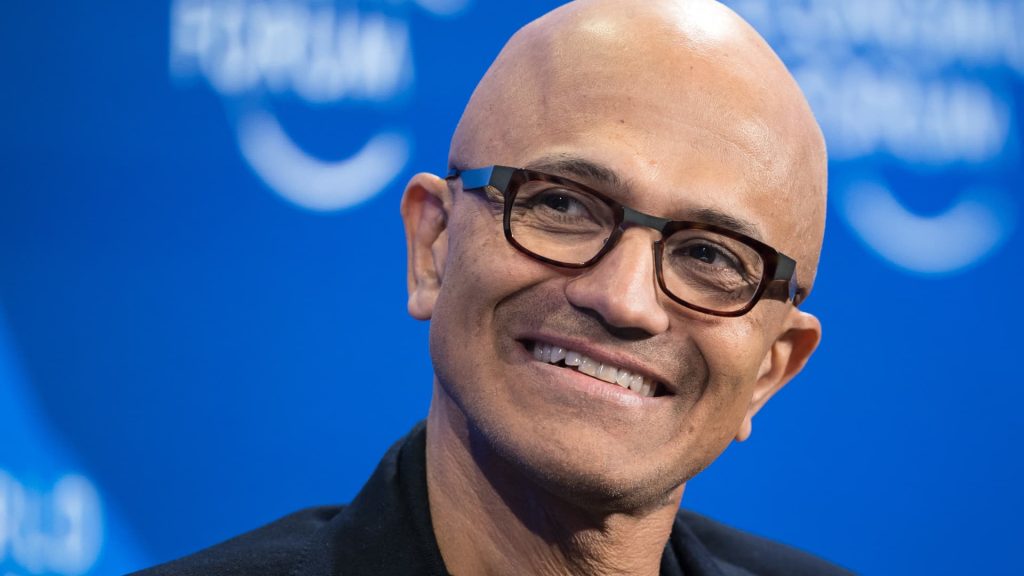

Microsoft’s GitHub Copilot code-generation tool now has 1.8 million paid subscribers, CEO Satya Nadella said on a conference call with analysts.

The Productivity and Business Processes unit containing Office productivity software, LinkedIn, Dynamics customer-relationship management software generated $19.57 billion in revenue, up around 12%. The StreetAccount consensus was $19.54 billion. This marks the first full quarter of sales of the Copilot add-on for commercial Microsoft 365 subscriptions. Copilot draws on AI models from OpenAI, in which Microsoft has invested billions.

Amgen is among the customers that have signed up for 10,000 seats for the Copilot, Nadella said.

Microsoft’s More Personal Computing revenue totaled $15.58 billion. Revenue from the segment, which includes the Windows operating system, Surface PCs, video games and search, increased approximately 18% and was above the StreetAccount consensus of $15.08 billion. Revenue from Xbox content and services was up 62%, thanks to a bump from the $75 billion acquisition in October of game publisher Activision Blizzard, including its popular Call of Duty titles.

Sales of Windows licenses to device makers popped 11%. Technology industry researcher Gartner estimated that PC shipments increased 0.9% in the quarter. Demand for PCs was “slightly better than expected,” Hood said.

During the quarter, Microsoft introduced Surface PCs with a key for quickly accessing the Copilot chatbot. The company started selling access to the Copilot for small businesses with Microsoft 365 productivity software subscriptions and hired Mustafa Suleyman, co-founder of artificial intelligence lab DeepMind, to run a new Microsoft AI group. Suleyman had been co-founder and CEO of startup Inflection, and many of its employees also joined Microsoft.

“We have been operating with speed and intensity and this infusion of new talent will enable us to accelerate our pace yet again,” Nadella wrote in a memo about the Inflection deal, which was reportedly worth $650 million.

Excluding the after-hours move, Microsoft stock is up 6% this year, in line with the S&P 500 index.