This week in Las Vegas, movie studios and theater owners will gather to bellow a simple message from the Colosseum stage at Caesars Palace, like King Kong roaring from the depths of Hollow Earth:

Movies are back.

Or perhaps more accurately, some movies are back. Alternatively, movies are more “back” than many people had thought they would be.

CinemaCon typically serves as an enthusiastic pep rally for the theater industry, full of heady exaltation for the magic of the big screen and defiant chest-thumping from the National Assn. of Theatre Owners, the Washington-based trade group.

The truth, however, is that the news for the box office has been mixed recently as the cinema business continues its long recovery from the COVID-19 pandemic and two overlapping Hollywood strikes that sapped the release schedule. On the plus side, though, it hasn’t been as bad as it could have been.

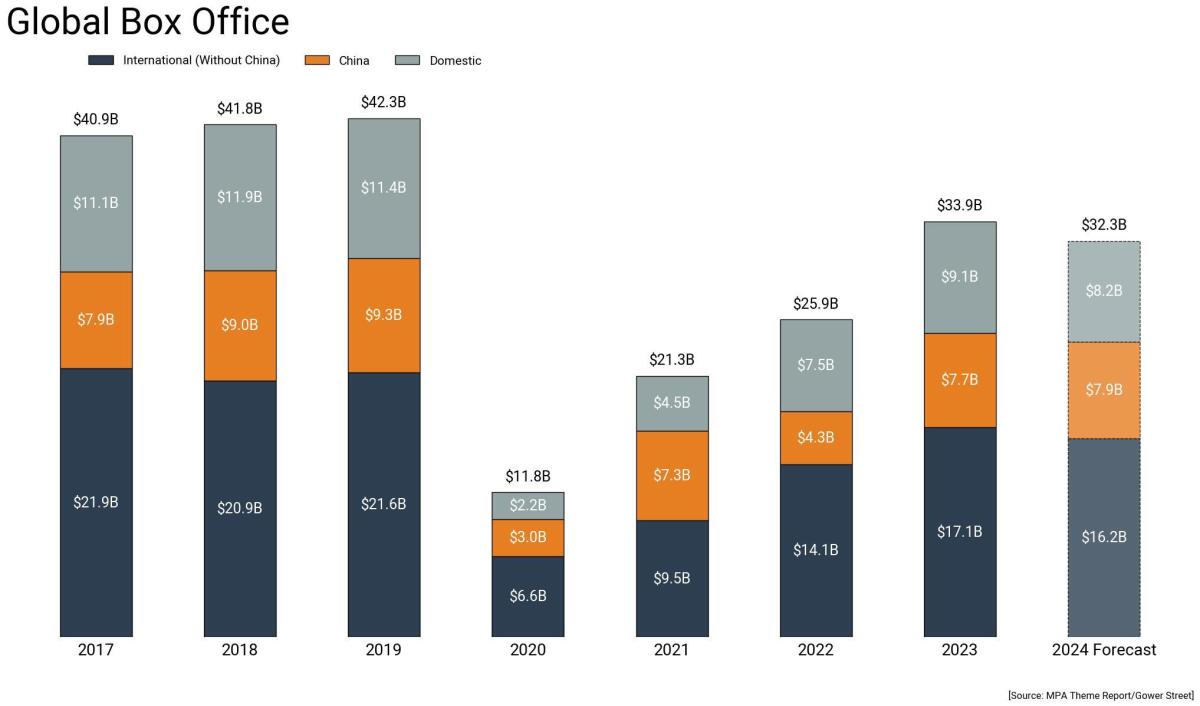

Film analytics company Gower Street on Sunday estimated that global box office for 2024 will total $32.3 billion, a mild improvement from the firm’s original projection of $31.5 billion published in December. Gower Street attributed the slight bump to better than expected first-quarter results from international markets, excluding China.

Still, the projection, if accurate, represents a 5% decrease from 2023 sales figures. The revised estimate for this year remains 18% lower than the average of the last three pre-pandemic years, the firm said. Total revenue hit a record $42.3 billion in 2019.

In the U.S. and Canada, the first three months of the year generated nearly $1.65 billion for the movie business, which was a tad better than expected but still down 6% from the same period of time in 2023.

Helping matters was a smattering of films that did better than expected, including “Dune: Part Two” ($265 million, domestic), “Godzilla x Kong: The New Empire” ($135 million) and “Bob Marley: One Love” ($96 million). Franchise installments “Kung Fu Panda 4” and “Ghostbusters: Frozen Empire” also brought audiences to their local multiplexes.

“The beat wasn’t on a breakout performance, instead, several films outperformed — a sign that consumer demand is robust w/ legs to next year,” wrote Wells Fargo analyst Omar Mejias, in a research report. Mejias upgraded the stock of Cinemark, the nation’s No. 3 cinema operator, to “overweight” (or “buy”), sending the shares soaring.

In a note to clients, B. Riley analyst Eric Wold said the latest results “demonstrate the resiliency of post-pandemic moviegoing demand.”

Most analysts think the domestic box office will total $8 billion to $8.5 billion in 2024, down at least 6% from the prior year. The second quarter got off to a slow start, with the Dev Patel action movie “Monkey Man” and 20th Century Studios’ “The First Omen” doing worse than expected (neither cost much to make, luckily for the studios).

As the overall results show, people still want to go to the movies. But they mostly want to see certain kinds of films more than others. Sequels and reboots continue to dominate the charts, though the occasional action thriller (“The Beekeeper”), rom-com (“Anyone But You”) or music biopic can poke through.

Each of the major studios at CinemaCon will try to make their splash with big upcoming movies for the rest of the year and beyond, though the all-important summer slate is thin compared with last year‘s, in part because of strike-induced production delays. (Want to follow the goings on in Las Vegas? My colleague Christi Carras is covering the event for The Times.)

Disney is betting on “Inside Out 2” to reverse its flagging fortunes in animation, as well as the next Marvel installment, “Deadpool & Wolverine”; Universal can tout “The Fall Guy,” “Despicable Me 4” and “Wicked”; Warner Bros. will try to keep its momentum going with “Furiosa” and its “Joker” sequel; and Paramount, as sale speculation abounds, has “A Quiet Place: Day One” and “Gladiator II” to crow about.

The presenter lineup reflects the quirkiness of the film business’ current state, in which niche programming can often do surprisingly well.

On Tuesday, Sony’s Crunchyroll will address exhibitors following the cinema owners association’s state of the industry rundown, a recognition of the increased power of anime on the big screen (props to GKids’ release of “The Boy and the Heron,” which recently grossed a strong $73 million in China). Later in the festivities, Angel Studios, the company behind last year’s surprise smash “Sound of Freedom,” will give a breakfast presentation.

There remain serious risks in the exhibition business. Attendance was on the decline even before the pandemic shuttered theaters, thanks to changing consumer habits and competition for people’s time and money from other entertainment options.

The industry has demonstrated an over-reliance on Imax-friendly studio action tent poles, when theater chains need a deep and diverse roster of movies in order to thrive. AMC, the world’s largest theater company, continues to see its stock price fall (down more than 50% so far this year) as it contends with its heavy debt load. Alamo Drafthouse has reportedly explored a sale.

It remains to be seen whether the global box office will ever get back to the $40 billion-plus days of 2019 and earlier years. A clearer picture will emerge in 2025 when the writers’ and actors’ strikes are further in the past. But overall, there’s a strong case that moviegoing has proved to be relatively sturdy despite persistent difficulties.

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

Andy Cohen turned Bravo into a cable powerhouse. Now the ‘king of reality TV’ faces his own drama. Bravo and the producers of shows such as “Real Housewives” face a slew of allegations and lawsuits claiming bullying, harassment and unfair labor practices.

Hollywood celebs are scared of deepfakes. This talent agency will use AI to fight them. WME is partnering with Seattle-based AI and image recognition company Loti to stop unauthorized digital use of images from clients, including deepfakes. Further reading: WME owner Endeavor to go private again.

CNN Originals looks for a comeback after cuts with space shuttle Columbia series. The division that has brought CNN ratings and an Oscar is bouncing back from slashed budgets. Its latest offering is a co-production with the BBC.

Studio owners revise plans for $1 billion update of historic Television City. Owners scale back plans for an upgrade of the legendary studio lot in response to neighbors’ concerns.

Elsewhere in the business:

Number of the week

According to a preliminary tally, Disney’s long-anticipated shareholder vote went just 31% in favor of dissident billionaire Nelson Peltz’s effort to join the Burbank giant’s board of directors, a decisive victory for Chief Executive Bob Iger.

Why didn’t the majority of investors buy what Peltz has been selling about Disney’s struggles? Peltz was better at diagnosing the Mouse House’s problems than he was at offering prescriptions, and even if the Trian hedge funder had a point (especially about the company’s bungled succession planning), he was not necessarily the right man for the job.

Anyway, no sooner did Iger vanquish his foe did the rest of us turn our attention to the question of who might replace him in 2026, assuming he actually retires this time, as planned.

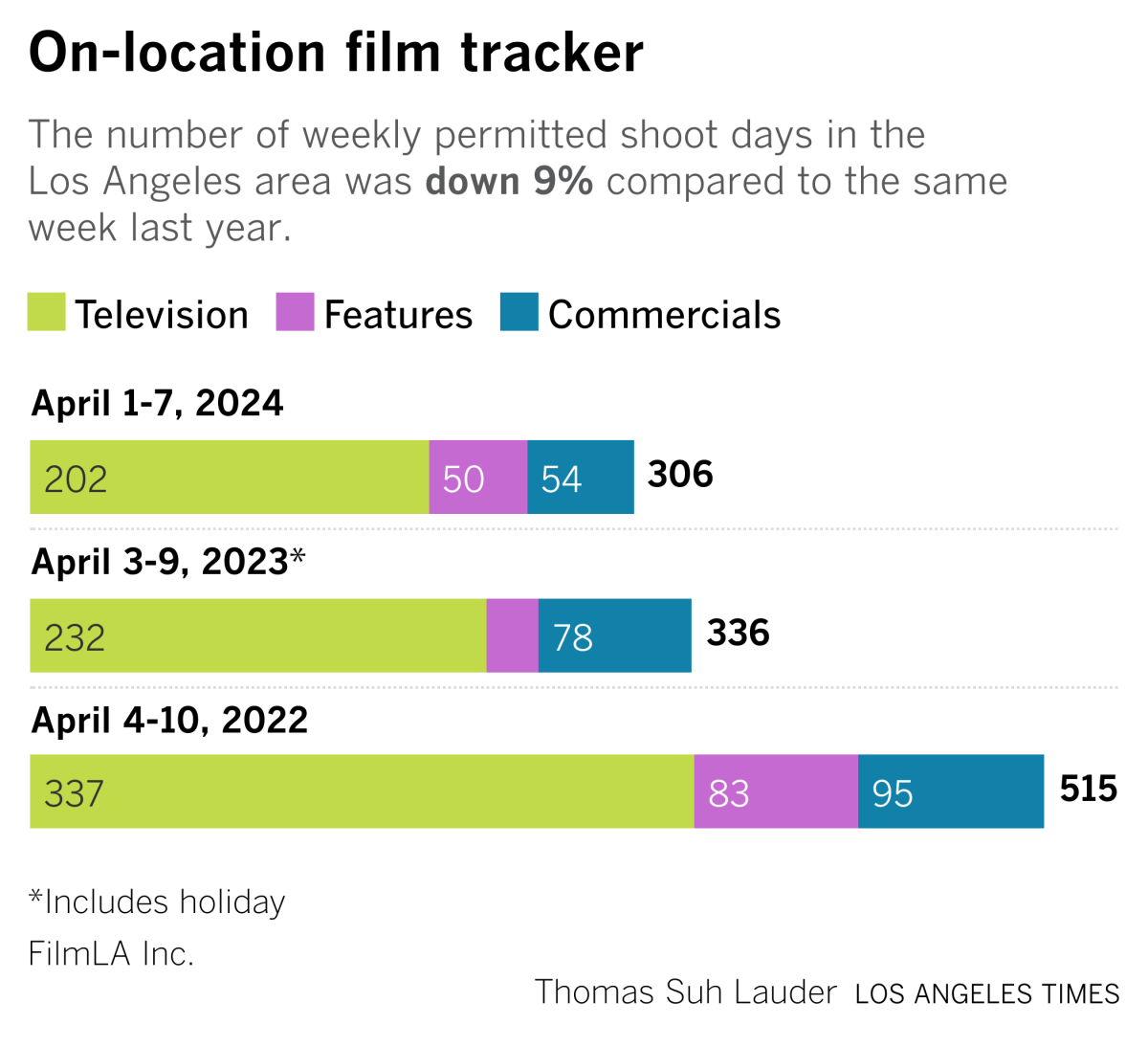

Film shoots

On-location shooting is still down from last year.

Best of the web

— TV ratings: NCAA women’s final sets another record. (Hollywood Reporter)

— A deal between Paramount Global and Skydance would work out (surprise) quite differently for Shari Redstone than for other investors (Wall Street Journal). One non-Redstone shareholder is already protesting.

— TikTok turns to nuns, veterans and ranchers in marketing blitz. The video app is spending millions on ads amid threat of U.S. ban. (New York Times)

— How ‘Bluey’ became a $2 billion smash hit with an uncertain future. (Businessweek)

— Trent Reznor and Atticus Ross have a plan to soundtrack everything. (GQ)

— The ballad of Ray Suzuki: The secret life of early Pitchfork and the most notorious review ever ‘written.’ (The Ringer)

Finally …

Take a spin through the Los Angeles Times’ definitive ranking of the 50 best Hollywood books of all time.

How many have you read?

This newsletter was written, in part, to the sounds of D.C. metal band Darkest Hour’s latest album, “Perpetual| Terminal.”