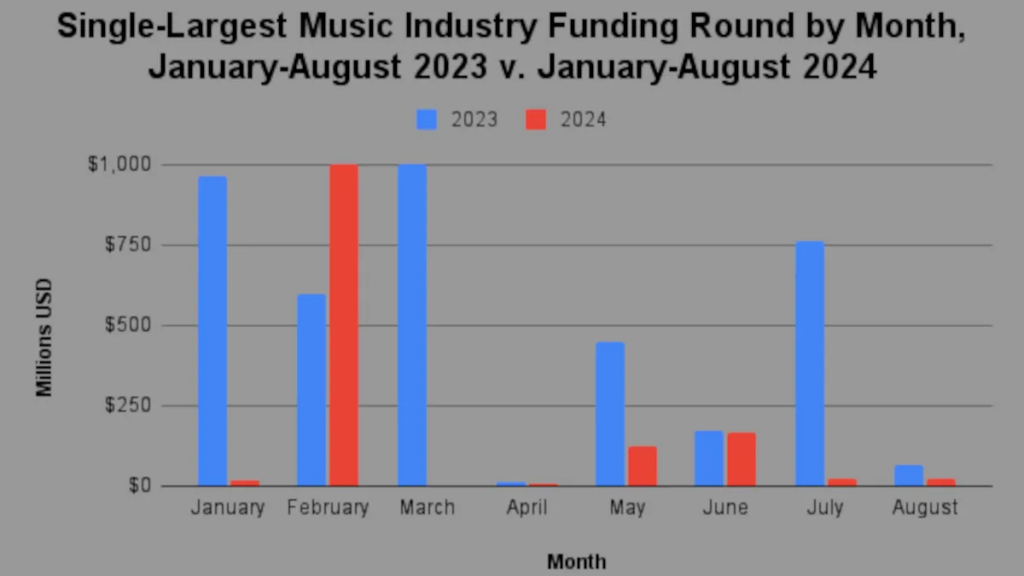

When it comes to the size of each month’s single-largest music industry funding round, 2023 topped 2024 in all but one comparison from January through August. Photo Credit: Digital Music News

How does August of 2024’s music industry funding stack up against that associated with the same month in 2023? Drawing from DMN Pro’s one-stop raise database, we analyzed the numbers to find out.

And at the top level, our answer points to a year-over-year decrease of 14.5%, from $100.02 million to $85.48 million. However, as has also been the case with our prior industry funding analyses, the hard stats don’t necessarily tell the whole story.

First, as mentioned, August of 2024’s average raise size, $12.21 million, outsized August of 2023’s just over $10 million. The latter period brought relatively small raises for companies including AI-powered music marketer Symphony (a $1 million pre-seed round) and sync-metadata startup Ringo (roughly $383,000 in pre-seed capital).

Next, the August of 2023 sum includes the $65 million secured by ticketing platform DICE; without the sizable raise, the stretch’s music industry funding would have totaled $35.02 million at a comparatively modest average of $3.89 million.

Running with the important potential for huge rounds to skew overall results, in keeping with clear-cut YoY music industry funding declines across other months in 2024, all but one of the single-largest monthly raises from January-August of 2023 topped those of January-August of 2024.

Admittedly, the 2023 months delivered an array of industry-adjacent raises (including but not limited to Amazon’s $1.25 billion Anthropic injection in September).

Even when disregarding these rounds in favor of those pertaining strictly to the industry, however, 2023 seemingly remains the funding frontrunner.

Keeping the focus on September – and similar trends are in place for months that can be compared in their entirety – India’s Kuku FM, which counts Google as a backer, raised a substantial $25 million the same month.

Nevertheless, we aren’t without positive takeaways on the 2024 funding side – as demonstrated by the relatively steady stream of raises that have come to fruition on the year.

Moreover, it should be kept front of mind that DMN Pro previously tracked a material funding increase in 2023 from the prior year – meaning that the 2024 numbers have a tough act to follow.

Looking ahead to the final third of 2024, it’ll be worth keeping an eye out not only for considerable raises attributable to the core industry, but also for those tied to the likes of OpenAI. Apple is reportedly in talks to back the ChatGPT developer.

Similarly, Daniel Ek-backed AI investment fund Air Street Capital has quietly participated in several interesting raises, some of which, like “Hollywood-grade visual AI” startup Odyssey, could make a splash in the entertainment sphere.