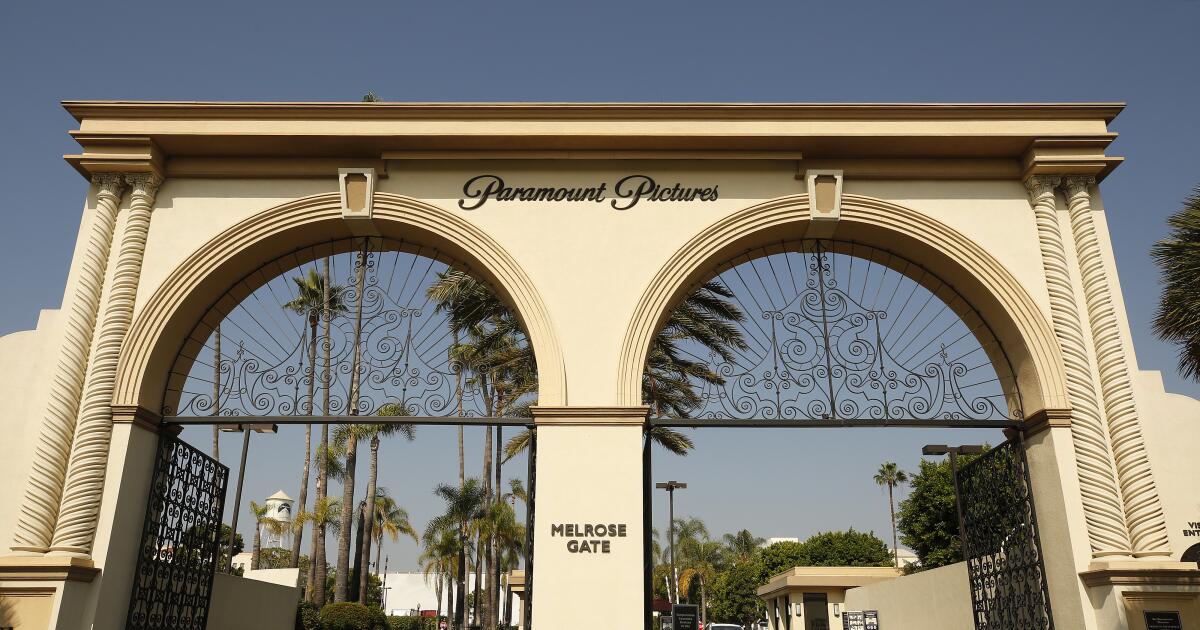

A for-sale sign has appeared on the lawn of Paramount Global, home of one of the most storied movie studios in Hollywood, popular television network CBS, and several other legacy brands and franchises.

Since last summer, multiple entertainment companies — including Skydance Media’s David Ellison and Warner Bros. Discovery — have been eyeing the media empire long controlled by the Redstone family through its National Amusements Inc. holding company. Rumblings of their movements have sparked fervent speculation about who might seal the deal and what yet another corporate merger could mean for the future of Paramount and the consolidating entertainment industry.

“Given the disruption going on within the … domestic box office and the industry overall, it’s almost too early to call what the true ramifications of one less studio would be,” said Robert Fishman, a research analyst at MoffettNathanson. “But it would clearly not help in terms of getting back to the peak levels that we saw pre-COVID.”

The Paramount saga has also raised questions about how one of entertainment’s oldest institutions — owner of coveted properties including “Star Trek,” “60 Minutes,” “Top Gun” and “Yellowstone” — has ended up in this position.

The company — the fusion of legacy players Viacom and CBS — has fallen on hard times. As the Hollywood business model continues to evolve and become more focused on streaming, Paramount, a company still largely reliant on network TV, cable channels and theatrical releases, “is getting boxed in from all sides,” said Sanjay Sharma, an adjunct professor of finance and business economics at USC’s Marshall School of Business.

“They need a massive investment to become a contender, to be a player among these giants,” Sharma said. “They are running out of options.”

How did we get here?

For more than 30 years, Sumner M. Redstone ruled the company, then known as Viacom, with a tight grip.

The hard-charging lawyer, businessman and Massachusetts movie theater owner outmaneuvered rivals to build one of America’s premier entertainment companies. He bought Paramount Pictures in 1994, and CBS five years later. He split the company in 2006, in part so he could collect compensation and dividends from two firms instead of one.

As Redstone’s health began to diminish more than a decade ago, Viacom slogged through a period of questionable management and under-investment that left it on shaky legs to compete in such a fast-changing landscape. Shari Redstone, Sumner’s daughter, forced out Viacom leaders in 2016. Her next move was to merge Viacom with CBS, which she accomplished in December 2019. (Sumner Redstone died in 2020).

At the time, the recombined company was worth $30 billion. It was renamed Paramount Global and launched streaming service Paramount+, replacing CBS All Access. The Redstone family owns about 10% of the equity in Paramount Global. But thanks to a dual stock structure, the family holds 77% of the voting shares, which gives it control.

Wall Street has since soured on Paramount, due to Netflix’s rise, the COVID-19 pandemic and last year’s twin Hollywood strikes, which turned off the content spigots. The company is now valued at $10 billion — making the Redstone family’s stake worth about $1 billion.

Amid its troubles, Paramount cut its dividend last May — significantly reducing the Redstone family’s source of steady cash. Redstone brought in merchant bank BDT & MSD Partners and its capital arm, which paid $125 million to become a preferred investor in National Amusements. The firm then set out to help Redstone restructure NAI’s debt obligations and investments.

BDT‘s founder, Byron Trott, is now leading Redstone through what has snowballed into a full-blown auction.

Who’s buying?

So far, there are three prominent industry players confirmed to be circling Paramount: Ellison’s Skydance Media, possibly with help from private equity firm RedBird Capital; David Zaslav’s Warner Bros. Discovery and Byron Allen’s Allen Media Group.

The first to express interest was Skydance, which has been looking to potentially purchase a controlling stake in National Amusements from the Redstone family. The acquisition would be the first step in a larger plan by Ellison to then merge his nearly 14-year-old company with Paramount.

Those talks have been in early stages, according to people familiar with the situation who were not authorized to comment. Ellison’s interest in buying National Amusements intrigued Shari Redstone, in large part because of his success as a movie producer of Paramount blockbusters including Tom Cruise’s “Top Gun: Maverick,” his deep love of films and his relative youth, which is viewed as a plus amid the generational industry shifts, according to a person close to the process but not authorized to comment publicly.

It doesn’t hurt that his father is billionaire Oracle Corp. founder Larry Ellison.

The parties would have to iron out terms that are palatable to Redstone, who must weigh the tax fallout of the all-cash deal that Ellison is seeking. Absorbing Paramount’s studio operations is the main priority for Ellison, per one insider, and he would have to decide whether to keep or spin the company’s TV brands — such as CBS, Nickelodeon, Comedy Central, BET, MTV and VH1 — and Paramount+.

Ellison has been open to considering holding on to television assets, one of the knowledgeable people said, because CBS’ and the other channels’ programming feeds Paramount+ .

Next in line was Zaslav, who met with Paramount Chief Executive Bob Bakish in December to mull over the idea of merging their companies, according to people who were briefed on the matter. Zaslav was interested, knowledgeable people say, because his company needs a boost and its streaming service Max, despite having HBO content, is far from the front of the streaming pack.

But Warner Bros. Discovery investors balked at the prospect of a Paramount purchase. Warner Bros. Discovery already is struggling to pay down its $40 billion in debt, and most analysts see the company as a takeover target.

This week, another possible contender has entered the chat: Allen, who submitted a $14.3-billion bid to purchase all of Paramount Global’s outstanding shares . Allen’s offer of $28.58 for each voting share is a considerable premium to the current price. Allen reportedly offered $21.53 for each nonvoting share. His company would also absorb nearly $15 billion in Paramount debt.

Analysts have have cast doubt on Warner Bros. Discovery’s ability to pull off a deal because of its mountain of debt; and some also have questioned Allen’s financial muscle.

Allen, a comedian turned media mogul, owns a cadre of television assets including the Weather Channel and Cars.TV. He has made offers in the past for assets including Paramount’s BET and VH1, as well as local station owner Tegna, but those bids never came to fruition. (Paramount opted not to sell BET and VH1 after all.) However, some analysts see potential in Allen’s pitch for Paramount.

“Byron has built a very interesting business. And you have to ask: If the house is on fire and everyone is running out of the house, then why would Byron be trying to run inside?” asked Corey Martin, a managing partner of the Beverly Hills law firm Granderson Des Rochers. “He has accumulated a lot of local television station affiliates and he could derive synergies by having national scale. And CBS has NFL football.”

Mario Gabelli, whose Gabelli Funds holds voting-class shares in Paramount, said Thursday, “If the dust settles in the way that I think it will, then Byron Allen could be the right partner for the TV stations.”

In a statement provided Wednesday to The Times, Allen Media Group touted the offer as “the best solution for all of the Paramount Global shareholders,” adding that “the bid should be taken seriously and pursued.”

Unlike Ellison, Allen is angling to sell Paramount’s film arm and some of its intellectual property while keeping its streaming platform and TV channels, according to Bloomberg.

What happens next?

If debt-ridden Warner Bros. Discovery and Paramount were to merge, they would have the opportunity to expand their content libraries and consolidate costs.

Fusing Paramount+ and Warner Bros. Discovery’s Max (already a fusion of HBO Max and Discovery+) could potentially create a super-streamer capable of rivaling the likes of Netflix, Disney+ and Amazon Prime Video, Sharma said.

But it’s not guaranteed that consumers would be willing to pay extra for access to that augmented collection.

“If Warner Bros. is able to increase its subscription by $5 per month … and add Paramount assets in it, economically, that would make sense,” Sharma said. “But … if a library suddenly acquires science books, I may not want science books. So they say they will increase my subscription. I will say, ‘No, I will stop coming to this library.’”

A Warner Bros. Discovery-Paramount merger would also allow the companies to blend their sports and news operations.

On the other hand, a union between Paramount Global and Skydance could make sense, given the studios’ history of collaborating on various titles, including movies in the hit “Mission: Impossible” and “Top Gun” franchises.

Under the ownership of Skydance or Allen Media Group, the Paramount brand probably wouldn’t undergo much change because it’s stronger than either company, Sharma said. However, Ellison or Allen could opt to sell off certain Paramount assets to improve their bottom line.

As of Thursday morning, one analyst who was not authorized to comment did not see a clear path to a deal for Warner Bros. Discovery or Allen Media Group. An agreement between Skydance and Paramount seems most likely, the analyst continued, given that the process of ironing out terms is reportedly underway.

“It’s appropriate that everyone is talking,” said the investor Gabelli. “That’s what business is all about.”

J. Clara Chan and Stephen Battaglio contributed to this report.