Understanding your audience is fundamental to success in business. The digital age has ushered in unprecedented access to consumer insights. Enter Qloo, an AI-driven analytics platform that processes over half a billion data points related to consumer behavior and preferences. Qloo’s core technology, Taste AI, integrates information across diverse consumer touchpoints including brands, media, sports, events, film, travel, and dining – all while maintaining user privacy by avoiding personally identifiable data. This comprehensive approach allows for nuanced insights into consumer tastes and habits. By offering API access to this rich dataset, Qloo enables businesses to boost revenue and enhance customer engagement seamlessly with a single line of code. The platform has attracted an impressive roster of clients spanning various industries, including entertainment giants like Netflix, food and beverage leaders such as Starbucks and PepsiCo, music powerhouse Universal Music Group, advertising firm JCDecaux, hospitality providers like Tablet Hotels, the renowned Michelin guide, and ticketing leader Ticketmaster.

AlleyWatch caught up with Qloo Cofounder and CEO Alex Elias to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total funding raised to $77M, and much, much more…

Who were your investors and how much did you raise?

We raised a $20M growth investment from Bluestone Equity Partners (“Bluestone”), the institutionally-backed global private equity firm focused on the Sports, Media & Entertainment industry.

Qloo marks the fourth investment for Bluestone from its inaugural $300M fund launched in a single closing during the first quarter of 2023. Bluestone is differentiated within Sports, Media & Entertainment private equity through its combination of blue-chip industry operating and investment experience, expansive international network, institutional capital base, and collaborative synergistic approach with portfolio companies.

Tell us about the product or service that Qloo offers.

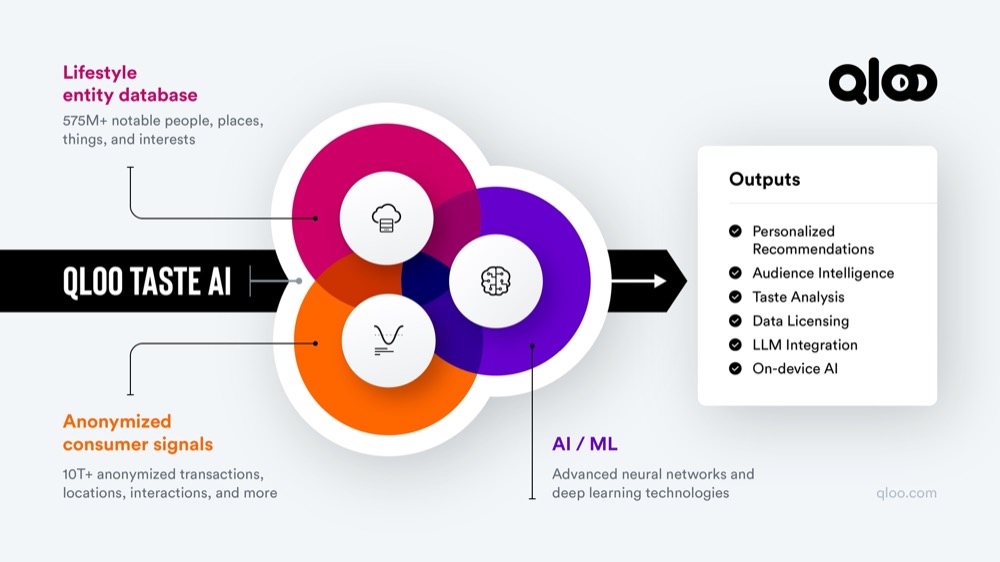

Qloo operates a sophisticated AI-powered intelligence engine, known as Taste AI, composed of highly accurate behavioral data detailing how consumers around the globe interact with more than half a billion lifestyle entities including brands, media, sports, live events, film, travel, dining, and more. For over a decade, Qloo has curated this unmatched data set and developed an applied-AI technology to help companies better understand and predict consumer preferences, while preserving customer privacy.

Qloo’s proprietary AI models are capable of identifying trillions of connections in milliseconds, assisting businesses small and large – from local businesses to some of the world’s largest and most well-known brands – to make better decisions and personalize customer experiences in real time, without using personally identifiable information. Qloo services some of the leading companies in the world, including Netflix, Starbucks, Universal Music Group, PepsiCo, JCDecaux, Tablet Hotels, Michelin, and Ticketmaster.

What inspired the start of Qloo?

Qloo began in 2012 to revolutionize recommendation technologies. While studying for a J.D. at NYU Law School, I identified a market gap in unified taste prediction across different domains without using identity-based data. With a passion for culture and music, I noticed the fragmentation in taste knowledge despite companies like Spotify and Netflix creating data silos.

Qloo began in 2012 to revolutionize recommendation technologies. While studying for a J.D. at NYU Law School, I identified a market gap in unified taste prediction across different domains without using identity-based data. With a passion for culture and music, I noticed the fragmentation in taste knowledge despite companies like Spotify and Netflix creating data silos.

My Cofounder Jay Alger, with extensive experience in commercializing technology and leading the digital agency Deepend, brought his expertise in scaling businesses and understanding enterprise needs. Together, we created Qloo to bridge the gap between fragmented taste graphs and nuanced, multi-domain recommendations.

Qloo’s initial consumer product laid the groundwork for offering enterprises tools to understand consumer tastes in a privacy-conscious manner. Their vision gained validation when Twitter became one of their first major enterprise clients in 2015. As privacy regulations like GDPR and CCPA emerged, Qloo’s non-identity-based recommendations grew more relevant. The acquisition of TasteDive in 2019 further solidified their market position.

Today, Qloo combines cultural understanding with technological expertise, creating solutions that respect individual privacy and AI ethics while offering rich, personalized experiences.

How is Qloo different?

Unlike other technologies, Qloo’s API goes beyond mere personalization or location-based insights. With a profound understanding of consumer behavior for over 575 million entities worldwide, our technology enables contextualized personalization and deep insights into the intricate connections behind people’s tastes. From music to film and beyond, our specialized data, covering the entire planet, allows for precision down to hundreds of feet. We provide 750+ billion cultural correlations and insights, processing millions of new cultural data points daily to keep our clients at the forefront of evolving tastes, deploying up to 200 new meta-models each week.

What market does Qloo target and how big is it?

Qloo primarily partners with multinational consumer companies to drive growth by powering personalized customer experiences and large language models, superior recommendations, data-driven marketing strategies, and advanced audience intelligence. Within this extensive B2C market, Qloo has a specific focus on Financial Services, Travel/Hospitality, Sports, Entertainment, and Media brands.

What’s your business model?

Qloo grants real-time access to its Taste AI consumer intelligence engine through a flexible API, which is priced on either a fixed monthly fee or a variable usage-based model. Later this year, Qloo will launch a no-code, self-service insight platform, which will be priced on a per user basis.

How are you preparing for a potential economic slowdown?

The tailwinds from privacy-centric solutions and novel AI applications have greatly overpowered the headwinds from any potential slowdown. Qloo has seen widespread contract expansion from customers seeking our unique Taste AI solution, which is an essential component of personalized experiences. Qloo is also seeing growing demand from new addressable markets such as sports, entertainment, and live events — a key part of our partnership with Bluestone.

What was the funding process like?

This latest investment came about quite organically, as both Qloo and Bluestone saw the tremendous value that can be unlocked by bringing Qloo’s solution to new industries like sports and live events.

What are the biggest challenges that you faced while raising capital?

Qloo is atypical as an AI company in that we’ve been building our technology and proprietary database for over a decade. This creates considerable, and important, distance between Qloo and the other AI companies gaining attention during the current AI hype cycle.

What factors about your business led your investors to write the check?

“Qloo’s one-of-a-kind AI effectively and ethically generates added-value for virtually any consumer-facing business,” said Bobby Sharma, Bluestone’s Founder & Managing Partner. “It turns vast troves of underutilized existing company data into immediately impactful consumer insights and actionable opportunities, maximizing revenue opportunities at scale. We are excited to help bring this amazing technology deeper into the global Sports, Media and Entertainment industry and its unmatched breadth and depth of meaningful touchpoints with passionate consumers and viewers.”

What are the milestones you plan to achieve in the next six months?

- Address and meet demand from new addressable markets, including real estate, sports, entertainment and live events.

- Address new commercial surface area for Taste AI such as on-device learning and foundational models leveraging Qloo.

- Introduce an accessible, self-service interface later this year to make consumer and taste analytics available to small and mid-sized enterprises and individuals.

Pursue opportunistic M&A using our balance sheet along the lines of the TasteDive acquisition, which greatly expanded Qloo’s first-party data moat and corpus of cultural learning.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

My advice is to focus on one vertical and pursue product market fit there. Once you do, it’s much easier to attract investors who have LPs that are strategic to that vertical and are more likely to write a check as a result.

Where do you see the company going now over the near term?

In the near term, Qloo will utilize this opportunistic investment for market expansion, launching a new self-service insights platform, building out our team, and strategically acquiring novel data sources and technologies that enhance our core Taste AI technology. We’ll also expand into new addressable markets including real estate, sports, entertainment and live events.

What’s your favorite summer destination in and around the city?

I’m a big fan of art and music. Within NYC, I love the sculpture garden at the Noguchi Museum in Queens, and the summer concert series at MoMA PS1. Outside of the city, I enjoy visiting Dia Beacon and the Parrish Art Museum in Water Mill.