PHILADELPHIA (CBS/AP) — Philadelphia-based Republic First Bank was closed by state regulators Friday night and its assets were given to the Federal Deposit Insurance Corp., FDIC announced in a news release.

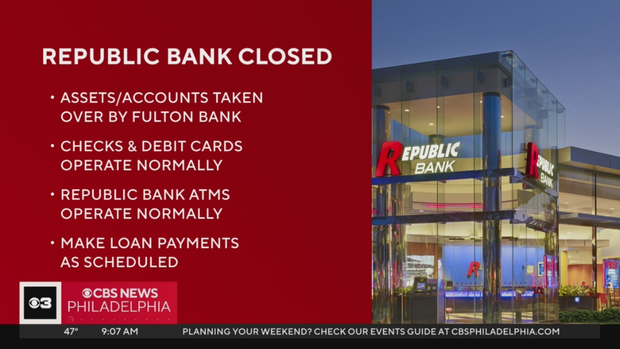

Republic Bank’s assets are now being taken over by Lancaster, Pennsylvania-based Fulton Bank effective immediately. Fulton is also assuming all deposits.

Republic First Bank is a regional lender operating in Pennsylvania, New Jersey and New York. The company did business as Republic Bank and had roughly $6 billion in assets and $4 billion in deposits as of Jan. 31.

Republic Bank’s 32 branches will reopen as branches of Fulton Bank as early as Saturday. Republic First Bank depositors can access their funds via checks or ATMs as early as Friday night, the FDIC said.

If you have a Republic Bank ATM or debit card, or a check, you can still use them. If you have a loan with Republic, you should still make payments as normal.

“Depositors of Republic Bank will become depositors of Fulton Bank so customers do not need to change their banking relationship in order to retain their deposit insurance coverage,” the FDIC said. “Customers of Republic Bank should continue to use their existing branches until they receive notice from Fulton Bank that it has completed systems changes that will allow its branch offices to process their accounts as well.”

The bank’s failure is expected to cost the deposit insurance fund $667 million, but the FDIC said Fulton Bank acquiring Republic First Bank was the cheapest resolution.

Anyone with less than $250,000 in any bank account insured by the FDIC is protected even if that person’s bank fails.

Why did Republic First Bank fail?

The lender is the first FDIC-insured institution to fail in the U.S. in 2024. The last bank failure — Citizens Bank, based in Sac City, Iowa — was in November 2023.

In a strong economy, an average of only four or five banks close each year.

Rising interest rates and falling commercial real estate values, especially for office buildings grappling with surging vacancy rates following the pandemic, have heightened the financial risks for many regional and community banks. Outstanding loans backed by properties that have lost value make them a challenge to refinance.

Last month, an investor group including Steven Mnuchin, who served as U.S. Treasury secretary during the Trump administration, agreed to pump more than $1 billion to rescue New York Community Bancorp, which has been hammered by weakness in commercial real estate and growing pains resulting from its buyout of a distressed bank.

How to contact the FDIC and Fulton Bank

The FDIC says customers with questions about the acquisition can contact the FDIC at 1-877-467-0178.

The call center is open from 9 a.m. to 6 p.m. ET on Saturday and from 12 p.m. to 6 p.m. on Sunday, 8 a.m. to 8 p.m. on Monday and 9 a.m. to 5 p.m. on days afterward.