For more than a week, Paramount Global has been poised to accept David Ellison’s bid for control of the troubled media company. But one big question hangs over the protracted deal talks:

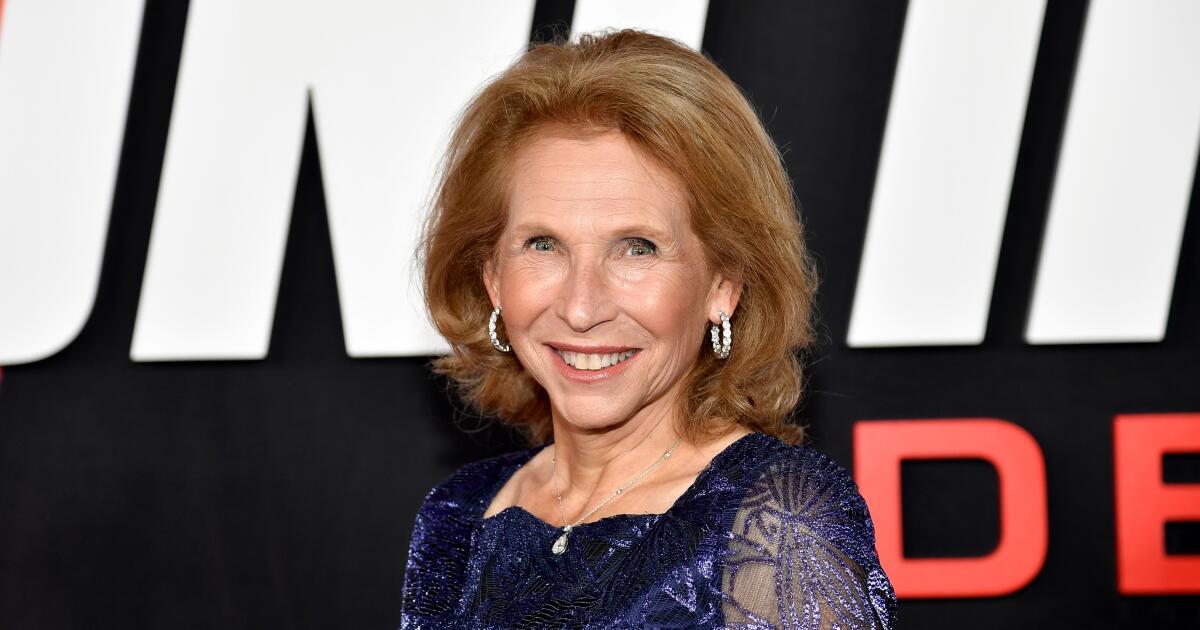

Will Paramount’s controlling shareholder Shari Redstone and her three children ultimately approve the deal?

People close to the sale process say Ellison’s production company, Skydance Media, and its financial backers are close to finalizing a deal that Ellison has been pursuing since last summer. On Monday, following a weekend of negotiations, lawyers for the two sides — Skydance and the Redstone family — had agreed on several major outstanding issues but were still grappling with remaining deal points, according to three knowledgeable people who were not authorized to comment given the delicate nature of the talks.

The lengthy and public auction — elongated by a six-month review by Paramount’s board committee of independent directors — has been complicated by an additional wrinkle. In recent weeks, two other potential suitors have expressed interest in buying the Redstone family’s investment vehicle, National Amusements Inc., which holds the 77% of voting shares in Paramount.

The arrival of two prospective new bidders — who appear willing to pay the family more than what’s contained in the Skydance offer — has increased the pressure already facing the heirs of late media mogul Sumner Redstone.

Former top Seagram and Warner Music executive Edgar Bronfman Jr., as well as Hollywood producer Steven Paul (“Ghost in the Shell,” “Baby Geniuses”), have separately expressed a desire to buy National Amusements, two of the knowledgeable people said. The Wall Street Journal first reported Bronfman’s and Paul’s interest.

But any deal with Bronfman, who is backed by Bain Capital, would be contingent on performing due diligence, according to one of the knowledgeable sources. The former entertainment executive and liquor scion — who pushed his family to acquire Universal Studios Inc. before selling it to France’s Vivendi more than two decades ago — has suggested paying more than $2 billion for the Redstone firm.

Separately, Paul has been trying to line up financial backers to make an offer of about $3 billion for National Amusements.

Ellison’s Skydance deal structure is dramatically different from the proposals by Paul and Bronfman.

Representatives of Paramount and Redstone declined to comment.

Ellison’s proposed $8-billion takeover is a two-step process. First, his group would buy National Amusements, which would give the Redstone family an exit from the movie business after more than 80 years.

The Skydance deal currently earmarks $2.3 billion to buy National Amusements. Of that, nearly $600 million would be used to pay off NAI’s debt, which includes loans taken out by the late mogul. His heirs would collect about $1.7 billion, according to the knowledgeable sources.

Ellison’s vision is to consolidate his smaller Santa Monica-based Skydance movie, TV and animation company with Paramount and run the merged entity as its chief executive. The Skydance deal is structured so that the bulk of the money would be distributed to Paramount and its shareholders.

That phase of the deal requires approval of the Paramount board, which is why Ellison and his group needed to negotiate acceptable terms with the media company’s directors who are not affiliated with the Redstones. That process began last December.

The tech scion’s bid is backed by RedBird Capital Partners, private equity firm KKR and his father, Larry Ellison, co-founder of software giant Oracle Corp.

Their offer includes setting aside $4.5 billion for Paramount’s nonvoting shareholders, who could tender some of their stock at $15 a share. Another $1.5 billion would be injected into Paramount’s battered balance sheet, allowing the company to pay down some of its heavy debt load. While negotiating with Paramount board members, the Ellison group twice upped its offer, in part to find ways to satisfy nonvoting shareholders who were upset that the Redstone family would be paid a premium for their shares.

Paramount closed Monday at $11.98 a share, virtually unchanged.

The Paramount sale has been among the messiest media deals ever, analysts said.

The company’s two-class stock structure is the root of the problem, said University of Delaware corporate governance expert Charles Elson.

“This is a recipe for high conflict and significant problems,” Elson said. “Whenever you have dual-class shares, that eliminates some of the checks and balances that a normal corporation would have. There’s really no check on [Redstone’s] decision-making.”

Once lawyers for both sides have reached consensus, the deal will be presented to National Amusements, whose board of directors includes Shari Redstone, her three adult children and several longtime advisors. The family’s inheritance is expected to be divided among Sumner Redstone’s five grandchildren, according to his trust documents.

Paramount’s full board, which includes Redstone as its nonexecutive chair, also must ratify the deal.

Weighing on the family is the timing of the deal — when Paramount shares have performed sluggishly.

A year ago, Paramount cut its dividend to shareholders, and the stock tumbled. The Paramount dividend was a major source of income for National Amusements.

A decade ago, shares of Paramount — then known as Viacom — were trading above $70 a share, making the Redstone family multibillionaires. But management missteps and the industry’s shift to streaming have pummeled Paramount Global (the company created from the combined Viacom and CBS). The entertainment company is worth $8.3 billion — about a third of its value of just five years ago.