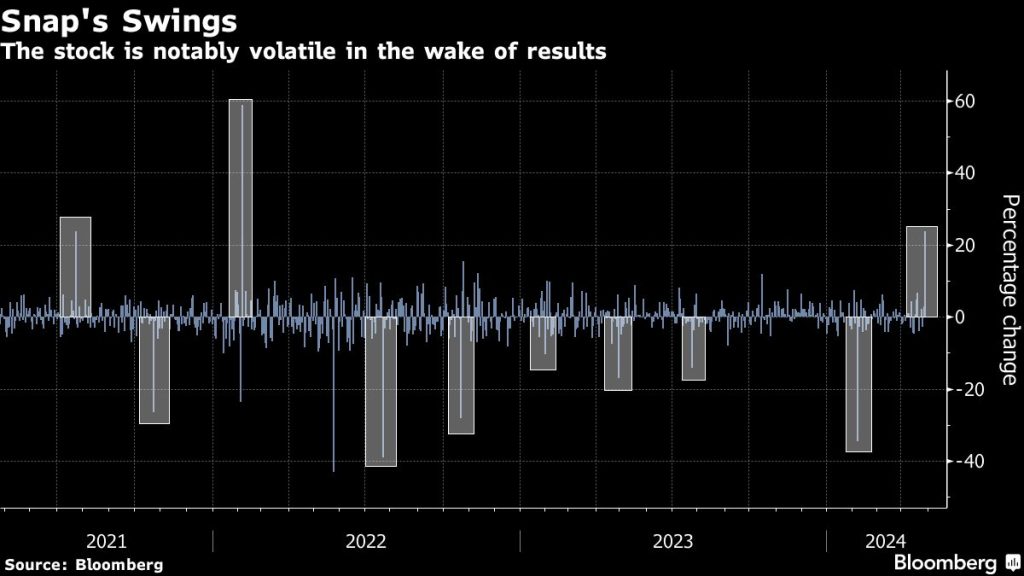

(Bloomberg) — Snap Inc.’s sizable post-earnings swing Friday is nothing new to its investors. What’s different this time is the direction: up.

Most Read from Bloomberg

Shares of the Snapchat parent gained as much as 30%, the latest example of the social-media company’s history of huge moves on quarterly reports. Since the second quarter of 2021, ten of the last 12 reports have been met with double-digit swings, with the moves ranging from a selloff of almost 40% to a gain of nearly 60%.

The average price move in response to the company’s earnings has been a swing of 19.8%, according to data compiled by Bloomberg. Among its ten nearest competitors in the Internet media & services industry, Roku Inc. is the only one that is similarly volatile, averaging a 16% move. The average for the group is roughly half of Snap, at 10%.

Friday’s rally came after Snap gave a strong sales forecast, easing concerns about its prospects and spurring at least one analyst upgrade. This is the first time the stock has seen a positive share-price reaction to results since April 2022.

The results have otherwise served as negative catalysts. Prior to the most recent report, Snap’s past seven reports triggered selloffs. In February, shares ended down about 35% after the fourth-quarter results underlined growth concerns. Even with Friday’s gain, the stock remains down about 15% this year, compared with a gain of 24% for industry leader Meta Platforms Inc.

While most of the stock’s biggest moves over the past few years have been on earnings days, its biggest one-day drop occurred in May 2022, when it cut its forecast.

–With assistance from Tom Contiliano.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.