Among the splashy announcements Bob Iger made amid last week’s Walt Disney Co. earnings report was news that could provide a window into how the Burbank entertainment giant is looking at its digital future in 3-D.

The company announced a deal with “Fortnite” developer Epic Games to create a new “games and entertainment universe” with Disney brands, including Star Wars, Marvel, Pixar and Avatar. Disney is investing $1.5 billion in Cary, N.C.-based Epic for a minority stake of an undisclosed percentage.

While the details of the pact remain somewhat vague — a video accompanying the announcement said the results of the collaboration would arrive “soon(ish)” — the fact that Iger spoke about the deal on the earnings call is a sign of its significance to the company.

“This marks Disney’s biggest entry ever into the world of video games and offers significant opportunities for growth and expansion,” Iger told analysts. “This new universe from Disney and Epic provides us with a tremendous opportunity to not only meet more consumers where they are, but to allow more audiences to cultivate a bond with Disney’s iconic brands and franchises.”

This deal comes as Iger tries to turn the page on a challenging opening chapter for his second run as Disney’s chief executive, which was dominated by his efforts to fix what had gotten the company off track during the Bob Chapek era. That meant billions of dollars in cost-cutting and thousands of layoffs while its studios suffered from flops including “The Marvels” and “Wish.”

Investing in a growing digital space signals to stockholders that Iger is serious about playing on offense again, despite incoming attacks from outside agitators including billionaire Nelson Peltz.

And as my colleague Sarah Parvini has written, games have become an increasingly powerful segment of the attention economy, especially among younger consumers spanning millennials, Gen Z and Generation Alpha. Disney has reinforced this with its past dealings with Epic, which has had major tie-ins with both Marvel and Star Wars.

“If you’re going to be a relevant, growing player, you better have gaming in your kit bag,” Raymond James analyst Ric Prentiss told The Times’ Christi Carras. The goal, Prentiss continued, is “not just to create a game, but to create an environment where people spend a lot of time.”

Matthew Ball, author of “The Metaverse: And How It Will Revolutionize Everything,” has for years argued that Disney was a likely candidate to benefit from the kinds of gaming and entertainment collaborations for which Epic is known.

This is not unfamiliar territory for Iger & Co. Disney used virtual reality headsets to create its blockbuster 2019 remake of “The Lion King” and also used Epic’s Unreal Engine in a number of ways, including for the production of the first season of “The Mandalorian.” Epic participated in Disney’s accelerator program in 2017.

“[A]s more technologies have come available that support more interaction, higher volumes, greater intimacy, we’ve seen the strongest and most beloved franchises become stronger and more beloved,” Ball told me in 2022. “The metaverse, as another medium for expression, exploration, creation and storytelling, will strengthen companies like Disney, even if it also enables new stories and intellectual property that thrive.”

Disney has previously made future-looking technology investments that fell flat. One need only mention the company’s $500-million bet on YouTube creator network Maker Studios to show that not everything Iger touches turns to gold. But that hasn’t stopped the company from trying to create content and applications for new technologies, as it did with its Disney+ app for the recently released Apple Vision Pro headset.

After some struggles, Disney has figured out a model to succeed in the gaming space without being a publisher itself. Disney adopted a licensing strategy in 2016, working with outside companies to bring its franchises to the gaming industry, including with last year’s hit “Marvel’s Spider-Man 2.” But while Disney isn’t a game maker itself, in contrast with “Hogwarts Legacy” studio Warner Bros., its employees are still intensely involved in the storytelling aspects of the resulting products.

One question is how far this ambitious project with Epic could move the entertainment industry toward a kind of metaverse — or, as Ball defines it, a version of the internet where users can move seamlessly through virtual worlds, kind of like in Ernest Cline’s novel “Ready Player One” (and the Steven Spielberg/Warner Bros. film of the same name). Epic, along with online interactive platform Roblox, is among the companies best positioned to push the world into the internet’s next evolutionary stage.

When Chapek was in charge of Disney, he established a division focused on “next generation storytelling,” referring to the metaverse as another “canvas” for creators. The intentions were always a little nebulous, and the unit was shuttered last March, just months after Iger’s return.

Moreover, the whole concept of the metaverse became the subject of mainstream scorn, in no small part thanks to Mark Zuckerberg’s efforts to popularize it.

But despite the demise of Disney’s metaverse group, the company clearly remains interested in a future in which fans can interact virtually with its various franchises.

Iger’s efforts to turn Disney around have a long way to go, and many of his most pressing challenges have to do with preserving traditional business models (e.g., theatrical films), adapting to changing consumer behavior (cord cutting, especially when it comes to ESPN), reinvigorating the film studios and cutting losses in streaming. However, although accomplishing all of those tasks is key, media companies also need to keep up with how their younger customers want to spend their leisure time.

“We have worried that by only trying to play catchup in streaming and ignoring a more interactive future, the company will remain on the hamster wheel,” wrote LightShed analyst Brandon Ross in a blog post. “Disney’s investment in Epic and ambition of creating a persistent virtual theme park adjacent to ‘Fortnite’ is perhaps the best possible solution for Iger.”

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

Why Bob Iger’s second act at Disney is looking brighter after a rough start. Just months ago, it looked as though Disney CEO Bob Iger was struggling in his return to the legendary Burbank company. Now, he is on offense again as the company faces two boardroom challenges.

In his last Super Bowl, CBS’ Sean McManus reflects on ‘the ultimate TV drama.’ The CBS Sports chairman, who joined the network in 1996, spent a lifetime in control rooms that brought the biggest events to the nation’s living rooms. The big game drew an average of 123.4 million viewers across all platforms, according to Nielsen.

Crew member dies after fall on the set of Marvel TV series ‘Wonder Man.’ The crew member, a lighting technician, died in a fall on the set of Marvel Studios’ “Wonder Man” at Radford Studio Center in the San Fernando Valley. His family called him ‘a stickler for safety at work.’

Talent agency A3 shuts down. A3’s demise comes about a month after A3’s digital and alternative content departments were sold to rival Gersh. After that deal, about 100 employees remained at A3.

Late night evolves slowly, as seen by ‘After Midnight’ and Jon Stewart’s ‘Daily Show’ return. Though streaming and social media have upended how viewers consume late-night series, innovation on the shows themselves has been much more stagnant.

He sought justice for George Floyd. His next target? Record labels. Attorney Ben Crump represented the families of George Floyd and Breonna Taylor. Now he’s hunting for unpaid royalties for Al B. Sure and Skid Row.

Number of the week

Pricing has yet to be announced for the sports-only streaming service set to be launched by Disney, Warner Bros. Discovery and Fox Corp. in their joint venture. As my colleague Stephen Battaglio wrote, analysts anticipate that the service will cost around $50 a month. It’s possible that it will charge less at first for promotional purposes. LightShed’s Rich Greenfield has estimated that the service will cost $35 a month at first.

The idea is that the new streamer will attract some of the 60 million households that don’t subscribe to a pay-TV package. If it charges too little, it won’t make money. But if the monthly fee turns out to be higher than, say, $60 a month, why wouldn’t customers just buy YouTube TV ($72.99) or something similar, like Sling TV? Remember, the new streamer won’t have Paramount Global or Comcast networks (such as CBS or NBC), which air plenty of sports.

Perhaps it’s more of a defensive strategy on the part of the media firms as the traditional pay-TV bundle collapses.

Disney, Warner Bros. Discovery and Fox may have felt that they had to make a move like this, as tech giants are increasingly moving sports viewership to their online platforms and paying ample amounts of money to do so. Amazon just picked up an exclusive NFL playoff game for next season, adding to what it’s already doing with its Thursday Night Football package. Meanwhile, Disney is still planning to launch its ESPN flagship direct-to-consumer service in fall 2025.

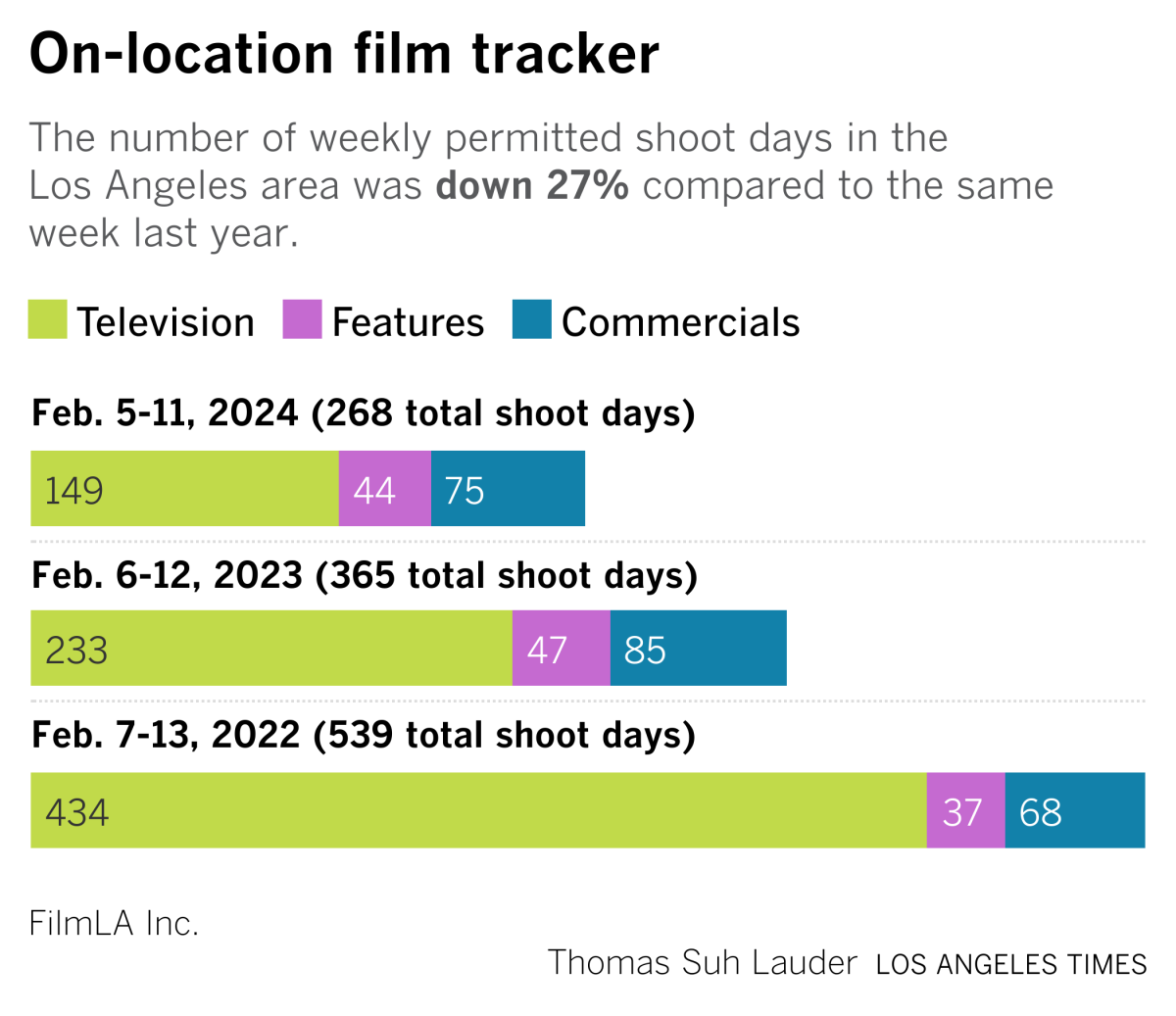

Film shoots

The latest production data from FilmLA.

Best of the web

— How GKids became the A24 of animated movies. (New York Times)

— The final days of ‘Coyote vs. Acme.’ (The Wrap)

— Everyone’s being weird about Tracy Chapman’s ‘Fast Car.’ (Vox)

Finally …

I’ve been doing a deep dive through Rick Rubin’s podcast. The interview with musician Nick Cave is especially interesting.