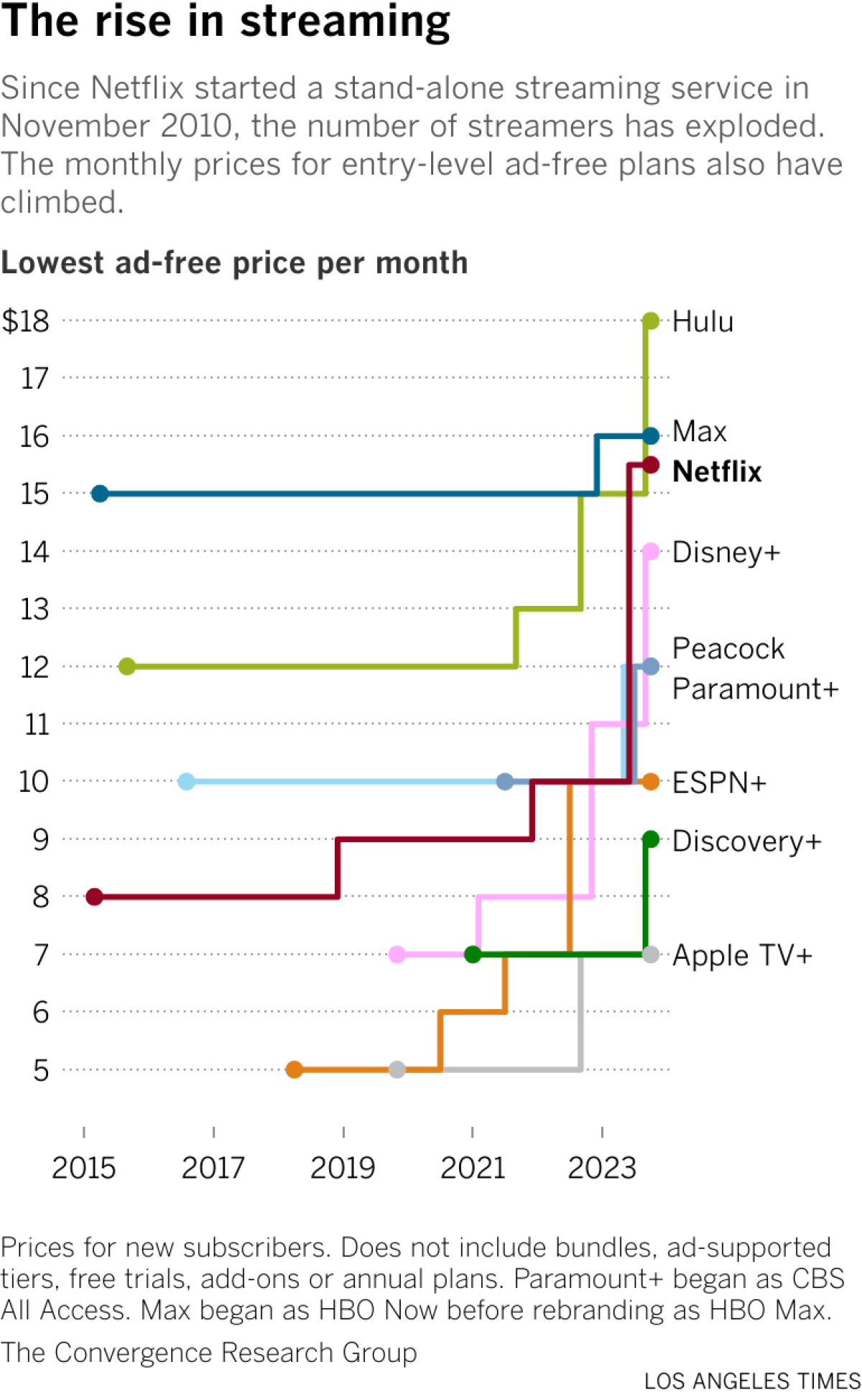

When a flood of streaming services entered the market four years ago, the free trials were plentiful and the prices were extremely low — with Apple TV+ selling for just $4.99 a month and Disney+ charging a mere $6.99 a month.

But now, as those services become more established, subscription costs have ballooned. In 2022, prices for the 10 largest streamers have increased an average of 10% and increased 10% on average in 2023 thus far, according to the Convergence Research Group, a market research company. Fees are expected to increase even more next year, the firm said.

Media companies are charging more as they struggle to transition from profitable but declining business models — like traditional television channels — to on-demand streaming services, many of which are still losing money. The surges in pricing come as consumers are grappling with inflation and broader economic uncertainty. People who abandoned expensive cable bundles in favor of cheaper streaming services are finding that their total monthly subscriptions add up quickly.

“They had to start that low because they were nobodies, but now they’re a plurality of TV viewing,” said Mike Vorhaus, CEO of Vorhaus Advisors. “So what do you do when you control the market? You raise the prices.”

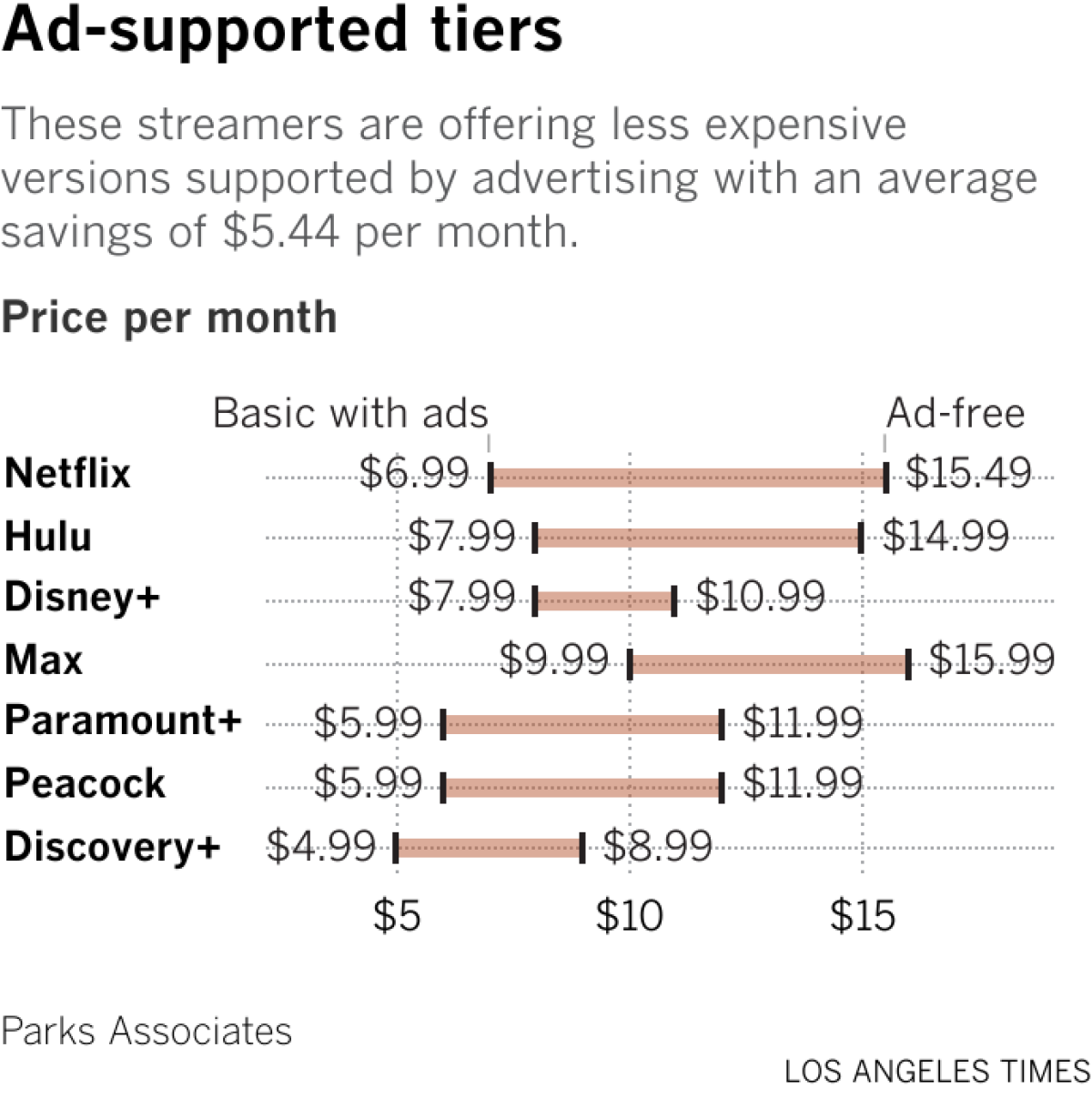

Netflix in July removed its cheapest ad-free option for new and returning members, which cost $9.99 a month. New subscribers now must choose between Netflix’s cheaper ad-supported tier ($6.99 a month) or its standard commercial-free version ($15.49 a month).

During the company’s second-quarter earnings presentation, Netflix’s CFO said the company was more than a year away from adjusting prices in the major countries where it operates. But the Wall Street Journal recently reported that Netflix planned to increase ad-free subscriptions after new contracts between major studios and the writers and actors guilds go into effect. Netflix declined to comment.

Rival streamers also have raised their prices. Last week, Discovery+ announced it will raise the fee for the ad-free plan by $2 to $8.99 plus taxes, and this month, ad-free Disney+ will go up by $3 to $13.99 a month. Meanwhile, Apple TV+ increased $2 to $6.99 a month in October 2022.

So why are costs going up, and what does it mean for consumers?

Why are we paying more to stream shows?

Many streamers are still losing money. Major studios were eager to chase Netflix’s business model of spending billions of dollars in content to attract millions of subscribers worldwide. They entered the market with low prices to gain market share and Wall Street applauded companies that saw surging subscriber growth. That changed in 2022 when Netflix for the first time in more than 10 years lost 200,000 subscribers — which led to a course correction where now Wall Street values profitability.

The increase in new customers has slowed since the early days of the pandemic, when people were sheltered at home and yearning for more entertainment that they could access from their couches. The number of paid U.S. streaming subscriptions added from 2023 to 2025 is expected to run at just under half of the subscriptions added from 2020 to 2022, according to Convergence.

“If they can’t gain as many subscribers, they’re going to have to increase their revenue at the end of the day,” said Convergence President Brahm Eiley.

While tech giants like Apple and Amazon make the bulk of their revenue through products and services outside of entertainment, companies such as Walt Disney Co. and Warner Bros. Discovery are struggling with the transition to online streaming from traditional businesses, like linear pay television.

Programmers are expected to see less revenue from traditional TV advertising and fees as viewers cut the cable cord and television ratings decline. In 2022, the pay TV industry lost 7.4 million subscribers , and that decline is expected to get worse this year, Convergence said.

If entertainment companies want streaming to make up the difference, they have to hike prices.

What effect will Hollywood strikes have?

New contracts for screenwriters and actors — coming after months of strikes by the Writers Guild of America and performers union SAG-AFTRA — will add additional costs to studios’ budgets.

The WGA valued the deal at $233 million a year, compared to the $86 million a year it estimated for what the studios previously offered.

The WGA’s membership has ratified the guild’s agreement reached with the Alliance of Motion Picture and Television Producers, which represents major studios including Netflix, Warner Bros. Discovery and Sony. The agreement provides wage increases and additional payment for much-watched programs on subscription streaming services.

Film and TV actors organized under SAG-AFTRA remain on strike and are continuing to negotiate with the AMPTP.

To be sure, services were likely to keep raising prices, with or without the dual strikes. But analysts expect the media and entertainment companies to pass the additional expenditures on to consumers while also pursuing other cost-saving measures.

“When you’re not profitable, you don’t tend to increase your payroll at the end of the day, unless there’s a massive opportunity for you,” Eiley said. “When your core business is not growing or declining and your new business is under tremendous competitive pressure you look to cut costs. … If we had to forecast, the consumer is going to pay for it.”

How much money can I save with ads and bundling?

Some streaming services, including Netflix and Disney+, have added lower-cost subscriptions with ads while hiking the price of their regular streaming options. Amazon said next year it will add advertising to Prime Video. Customers who wish to see Amazon films and shows without ads in the U.S. will pay an additional $2.99 a month.

Advertising could help drum up more revenue for streamers, while the lower cost appeals to frugal consumers. Advertisers for years have been interested in promoting their brands to cord cutters and younger audiences on Netflix, which in the past had been averse to ads. Now, companies can air commercials on the ad-supported Netflix plan, targeting viewers based on what genres they watch, such as drama or sci-fi.

Eiley said that, in some cases, lower-priced ad-supported plans have a higher average revenue per user than more expensive paid ad-free plans. “[T]he less expensive subscription approach makes sense with a maturing market,” he said.

On average, ad-supported services cost consumers about 45% less than ad-free subscriptions, according to Convergence. Research firm Parks Associates estimates that if consumers were to move all of their streaming services to cheaper ad-based tiers, they could save as much as $366 a year.

Analysts say it’s a good deal for viewers, in part because there are also fewer ads on streaming than on traditional television (for now). Streaming advertising loads on average are at 40% of TV advertising loads, according to Convergence.

“It’s a no-brainer for a vast majority of consumers,” Eiley said.

There’s another option for viewers, which is becoming increasingly popular — free, ad-supported streaming services like the Roku Channel and Amazon Freevee.

Some companies that own multiple streaming services offer savings to consumers through bundling. For example, a package deal of Hulu and Disney+ with ads costs $9.99 a month, compared to $7.99 a month for ad-supported Disney+ on its own. The ad-free version of the Disney+ and Hulu duo costs $19.99. A trio of Disney+, ESPN+ and Hulu costs $14.99 a month with ads as of Oct. 12.

Paramount Global, which previously offered Paramount+ and Showtime as a bundle, recently raised the price of its premium version of Paramount+ to $11.99 while adding Showtime content.

On average, bundles tend to save 20% to 40%, according to Convergence. Having multiple streaming services stitched together can make it easier for consumers who feel overwhelmed by the volume of entertainment choices and also expose them to other types of shows and movies that they might not see if they only subscribed to one service.

“The biggest benefit to consumers is a ton of content,” Vorhaus said. “People have shown they want that. So far, we haven’t seen that people are worried about spending $20, $40, $50, $60 a month for these services, and it’s still cheaper than traditional cable.”

Other companies like YouTube and Hulu also offer live TV options along with access to on-demand streaming services.

Staff writer Meg James contributed to this report.